Immunotherapy Drugs Market

Immunotherapy Drugs Market Share and Trend Analysis, By Drug Type (Monoclonal Antibodies, Immunomodulators, Vaccine), By Indication (Autoimmune Diseases, Infectious Diseases, Cancer), By End User (Hospitals, Cancer Centers, Specialty Clinics, Others) – Industry Analysis Report, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast, 2026–2033

Historical Period: 2019-2024

Forecast Period: 2025-2033

Report Code : ASIHIR1002

CAGR: 13.8%

Last Updated : February 6, 2026

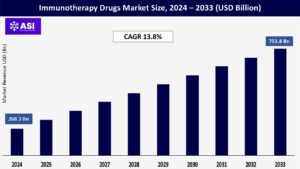

The global immunotherapy drugs market was valued at USD 268.3 billion in 2024 and is projected to reach USD 753.8 billion by 2033, growing at a CAGR of 13.8% during the forecast period (2025–2033).

Immunotherapy medications are a sophisticated group of drugs that promote or restore the immune system to detect and eliminate dangerous cells, including cancer or infected cells. In contrast to chemotherapy, which indiscriminately kills both normal and pathological cells, immunotherapy is more selective and typically has fewer side effects and improved long-term results. These treatments involve monoclonal antibodies that target specific sites on diseased cells, immune checkpoint inhibitors that remove the brakes on immune cells so that they can fight tumors, cytokines that activate immune responses, and therapeutic cancer vaccines that educate the immune system to target cancer antigens.

Immunotherapy has emerged as a critical weapon in the treatment of cancers such as lung cancer, melanoma, and lymphoma, and is being increasingly investigated for autoimmune diseases and infectious diseases such as HIV and hepatitis. With developments in biotechnology and personalized medicine, immunotherapy is fast becoming an integral part of contemporary healthcare, bringing new hope to patients with diseases that were previously deemed hard to treat.

The rising global incidence of cancer, autoimmune disorders, and chronic infectious diseases is significantly driving demand for immunotherapy drugs. According to the World Health Organization, there were 19.3 million new cancer cases and nearly 10 million cancer-related deaths globally in 2020. Aging populations, environmental exposures, and lifestyle changes continue to elevate disease prevalence, particularly in developed and rapidly urbanizing regions. Immunotherapy has emerged as a preferred treatment option due to its superior clinical outcomes and manageable safety profile.

Unlike traditional chemotherapy, which often involves high toxicity, immunotherapies offer targeted mechanisms of action, leading to durable remission and improved survival in patients with advanced-stage cancers. Flagship drugs such as Keytruda (pembrolizumab) and OPDIVO (nivolumab) have redefined treatment protocols across multiple cancer types, including lung, melanoma, and renal cancers. Additionally, the lower incidence of severe side effects makes immunotherapies more appealing to both patients and clinicians. The increasing effectiveness, personalization, and tolerability of immunotherapy drugs continue to drive strong market preference and sustained growth.

The immunotherapy drugs market is witnessing significant growth, fueled by rapid advancements in research and development and increasing strategic investments. Pharmaceutical and biotech companies are expanding their immunotherapy pipelines, with over 6,000 active immuno-oncology trials globally as of 2024. Innovative therapies such as checkpoint inhibitors, CAR-T cell treatments, bispecific antibodies, and therapeutic cancer vaccines are entering clinical phases or gaining regulatory approvals.

The U.S. FDA’s expedited programs, including Breakthrough Therapy and RTOR, are also fast-tracking product approvals. At the same time, public and private investments are driving innovation and commercialization. Notable partnerships such as Pfizer and BioNTech’s mRNA alliance and major acquisitions like Novartis’s 2024 USD 3.5 billion radioligand purchase highlight the strategic value of immunotherapy. In 2023 alone, global immunotherapy-related funding surpassed USD 15 billion, enhancing R&D, manufacturing, and clinical infrastructure. Together, these developments are not only accelerating the introduction of next-generation immunotherapies but also improving patient outcomes and expanding access to advanced treatments across multiple cancer types.

Despite the clinical success of immunotherapy, several challenges continue to limit its widespread adoption. One of the most pressing barriers is the high cost of treatment, with some therapies exceeding USD 100,000 per patient per year. These costs place a significant financial burden on healthcare systems and restrict patient access, particularly in low- and middle-income countries.

In addition, the delivery of complex therapies, especially CAR-T cell treatments, requires advanced infrastructure, specialized staff, and intensive monitoring. In many parts of the world, especially in developing nations, such resources are scarce. Even in high-income countries, rural and underserved communities may face limited access to immunotherapy centers. Regulatory and clinical hurdles also slow market expansion.

Immunotherapies must undergo rigorous clinical testing and safety evaluations, which extend approval timelines. Moreover, not all patients respond effectively to these treatments, and some may experience severe immune-related side effects such as cytokine release syndrome. These challenges, combined, hinder broader market penetration, particularly in resource-constrained or medically complex settings.

| Report Metric | Details |

|---|---|

| Segmentations | |

| By Drug Type |

Monoclonal Antibodies (mAbs) Immune Checkpoint Inhibitors Cancer Vaccines Cytokines and Immunomodulators |

| By Indication Type |

Cancer Autoimmune diseases Infectious diseases |

| By End-User |

Hospitals and Clinics Cancer Centers Specialty Clinics Others |

| Key Players |

Roche Merck & Co. Bristol-Myers Squibb Novartis AstraZeneca Johnson & Johnson Amgen GlaxoSmithKline Pfizer AbbVie Sanofi Gilead Sciences Regeneron Takeda |

| Geographies Covered | |

| North America |

U.S. |

| Europe |

U.K. |

| Asia Pacific |

China |

| Middle East & Africa |

Saudi Arabia |

| Latin America |

Brazil |

Monoclonal Antibodies are the market leaders, selling about 68.2% of total immunotherapy drug sales. Their success is due to their capacity to precisely target certain antigens on cancer cells, reducing harm to healthy tissues. mAbs not only identify cancer cells to be destroyed by the immune system but also disrupt tumor growth messages. Particularly notable are pembrolizumab (Keytruda) and nivolumab (Opdivo), both extensively approved for numerous cancers such as lung, melanoma, and renal cell carcinoma. Immune Checkpoint Inhibitors are a subclass of mAbs, and aimed at proteins such as PD-1, PD-L1, and CTLA-4, which are utilized by tumors to avoid immune detection. Through checkpoint blocking, the medications reanimate T-cells, allowing them to destroy cancer. Used extensively in advanced cancers, durable responses in melanoma, lung, and bladder cancers have been observed, with current trials underway in additional types of tumors as well.

Therapeutic cancer vaccines work to train the immune system to recognize and target cancer-specific antigens. Though still in the early stages, vaccines such as Provenge (for prostate cancer) and mRNA-based candidates have shown promise in clinical trials. Their personalized basis makes them a rising interest in precision oncology.

Cytokines and Immunomodulator agents, such as interleukins (IL-2) and interferons (IFN-α), work by activating immune cells such as T-cells and natural killer cells. Although older and increasingly used less often with the advent of newer agents, they are still useful in treating certain cancers including melanoma and renal cell cancer. New drug formulations and administration with checkpoint inhibitors are under investigation to enhance their therapeutic efficacy and decrease toxicity.

Cancer continues to be the main target of immunotherapy medications, with lung, breast, and melanoma cancers being the leading therapeutic areas. Lung cancer alone contributed around 13.8% of the overall immunotherapy market in 2024, fueled by the efficacy of monoclonal antibodies and checkpoint inhibitors in solid tumor treatment. The high efficacy, long-lasting response rates, and increasing approvals across cancer types continue to position cancer as the largest and most profitable segment.

Autoimmune diseases, such as rheumatoid arthritis, psoriasis, and multiple sclerosis, constitute a smaller but increasingly growing category. Pressure for safer, more selective therapies has driven volumes for biologics and monoclonal antibodies, like TNF inhibitors and IL-17 blockers. New pipeline products and second-generation immunomodulators are further driving growth in this category, especially in emerging markets with established reimbursement systems.

Infectious diseases are a new frontier for immunotherapy. They are being engineered to treat persistent infections such as HIV and hepatitis, in which conventional therapies are limited. The success of the use of monoclonal antibodies in the COVID-19 pandemic has revived interest in immunotherapy for viral infections, which has fostered additional research and governmental encouragement. The possibility of lowering viral load and increasing immune response holds bright prospects for long-term growth in this field.

Hospitals and Clinics account for the biggest share because of the intricacy of providing immunotherapy drugs. Around 50% of immunotherapy sales around the world take place through hospitals. Cancer centers perform advanced immunotherapies such as CAR-T infusions and are significant treatment volume contributors. Specialty Clinics: Specialty clinics with oncology or transplant specialization provide more outpatient treatment with rising frequency. Their percentage is growing as more subcutaneous or self-administered drugs are made available.

Others comprise home healthcare, ambulatory care, and research centers. These are supposed to expand gradually with new formulations, making it easier to deliver drugs.

North America continues to lead the market for immunotherapy drugs with a 42.8% share of total revenue in 2024, with the United States generating almost USD 79.4 billion. Drivers like excellent research infrastructure, high-speed approval processes by the FDA, and widespread insurance cover underpin the region’s market leadership. Continuous clinical trials, along with early embracement of newer treatments, further enhance the region’s share.

Europe is the second-largest region with a 2023 and a forecasted CAGR of 8.1% until 2033. Germany, France, and the UK continue to be the leaders in clinical research, public health support, and patient access. Nevertheless, tight cost-containment policies and slower reimbursement procedures can slow down quicker adoption.

Asia-Pacific has been the most rapidly growing region, with a CAGR of over 13%. Chinese, Japanese, South Korean, and Indian governments have been proactively investing in cancer care facilities and initiatives supporting indigenous drug development. Greater awareness and higher income are also inducing greater adoption of advanced therapies.

Latin America and the Middle East & Africa (MEA), collectively representing less than 10% of the worldwide market, are experiencing consistent growth. Continued healthcare reforms, enhancing diagnostic capabilities, and public-private collaborations are aiding in increasing patient access to immunotherapies in these emerging markets.

The market was valued at USD 268.3 billion in 2024.

The market is projected to grow at a CAGR of 13.8 % from 2025 to 2033.

Monoclonal antibodies hold the largest market share.

The Asia-Pacific region is expected to witness the highest growth rate.

Major players include Roche, Merck, BMS, Novartis, AstraZeneca, Pfizer, and others.

1.1 Summary

1.2 Research methodology

2.1 Research Objectives

2.2 Market Definition

2.3 Limitations & Assumptions

2.4 Market Scope & Segmentation

2.5 Currency & Pricing Considered

3.1 Drivers

3.2 Geopolitical Impact

3.3 Human Factors

3.4 Technology Factors

4.1 Porters Five Forces Analysis

4.2 Value Chain Analysis

4.3 Average Pricing Analysis

4.4 M & A, Agreements & Collaboration Analysis

5.1 Immunotherapy Drugs Market, By Drug Type

5.1.1 Introduction

5.1.2 Market Size & Forecast

5.2 Immunotherapy Drugs Market, By Indication

5.3 Immunotherapy Drugs Market, By End-User

6.1 North America Immunotherapy Drugs Market, By Country

6.1.1 Immunotherapy Drugs Market, By Drug Type

6.1.2 Immunotherapy Drugs Market, By Indication

6.1.3 Immunotherapy Drugs Market, By End-User

6.2 U.S.

6.2.1 Immunotherapy Drugs Market, By Drug Type

6.2.2 Immunotherapy Drugs Market, By Indication

6.2.3 Immunotherapy Drugs Market, By End-User

6.3 Canada

7.1 U.K.

7.2 Germany

7.3 France

7.4 Spain

7.5 Italy

7.6 Russia

7.7 Nordic

7.8 Benelux

7.9 The Rest of Europe

8.1 China

8.2 South Korea

8.3 Japan

8.4 India

8.5 Australia

8.6 Taiwan

8.7 South East Asia

8.8 The Rest of Asia-Pacific

9.1 UAE

9.2 Turkey

9.3 Saudi Arabia

9.4 South Africa

9.5 Egypt

9.6 Nigeria

9.7 Rest of MEA

10.1 Brazil

10.2 Mexico

10.3 Argentina

10.4 Chile

10.5 Colombia

10.6 Rest of Latin America

11.1 Global Market Share (%) By Players

11.2 Market Ranking By Revenue for Players

11.3 Competitive Dashboard

11.4 Product Mapping