Autonomous Bus Door System Market

Automatic Bus Door System Market Size, Share & Industry Analysis, By Bus Type (Shuttle Bus, Articulated Bus, City Bus), By Door Type (Folding, Sliding Plug), By Propulsion Type (ICE and Electric), Analysis Report, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast, 2025–2033.

Historical Period: 2019-2024

Forecast Period: 2025-2033

Report Code :

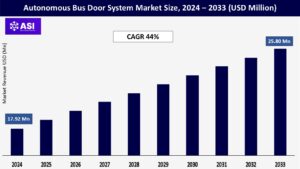

CAGR: 44%

Last Updated : February 3, 2026

The global autonomous bus door system market size was valued at USD 17.92 million in 2024 and is expected to grow from USD 25.80 million in 2025 to reach USD 476.98 million by 2033, growing at a CAGR of 44% during the forecast period (2025-2033).

The autonomous bus, also known as the self-driving bus, senses its surroundings and navigates by building an active 3D map using artificial intelligence (AI) software, light detection & ranging (LiDAR), RADAR, and cameras.

There are many levels of autonomy, from partially autonomous cars needing a driver to fully autonomous vehicles that don’t need one. Significant fuel volumes are burned while travelling at high speeds or accelerating and decelerating frequently. Lower emissions are produced because the autonomous bus uses less gasoline and batteries. The product benefits the environment as a result.

Rapid urbanization and an increase in population in many regions have steadily increased the demand for public transport, including buses. Growing cities and urban areas require efficient and sustainable transportation solutions to move many people.

As a result, there is a higher demand for buses, leading to an increased need for bus door systems. Traffic congestion and environmental pollution are significant challenges in urban areas. Many cities prioritize expanding and improving public transportation networks to reduce private vehicle usage and alleviate congestion.

Buses are crucial in providing efficient and environmentally friendly mass transit options, driving the demand for buses and related components, including bus doors.

Governments worldwide promote and invest in public transportation infrastructure to address mobility challenges and achieve sustainable development goals.

These initiatives include expanding bus fleets, improving existing public transport systems, and implementing smart city transportation solutions. As a result, the demand for buses, including automatic doors for buses, is increasing to meet these requirements.

Compared to traditional vehicles, autonomous vehicles provide several benefits, such as enhanced safety, reduced fuel consumption, less pollution, and reduced traffic congestion. An autonomous bus has many sensors, including LiDAR, RADAR, a camera, and GPS.

These short-range and long-range sensors help a vehicle detect any object or obstruction in its path, reducing the likelihood of accidents. The short-range sensors provide information about moving objects close to the vehicle, while the long-range sensors provide information about fast-approaching vehicles.

Autonomous vehicles can also reduce traffic congestion. According to research from the University of Illinois, a single autonomous car surrounded by 20 human-driven vehicles can reduce traffic congestion by controlling its speed. Because fuel consumption rises when a vehicle slows down, deploying autonomous vehicles reduces fuel consumption.

As a result of less traffic congestion and greater fuel efficiency, it is predicted that the autonomous bus door system market for self-driving buses will grow. The demand for automated bus door systems is expected to grow.

Automatic doors involve complex mechanisms and electronic components that require frequent maintenance to ensure optimal performance. Bus operators must have skilled technicians and spare parts available for timely repairs and replacements.

Reliability is crucial to maintain service continuity, and any system malfunctions or breakdowns can impact operational efficiency and passenger satisfaction. These door systems have various mechanical and electronic components, such as motors, sensors, control units, and wiring.

Any malfunction in these components can result in door operation issues, such as doors not opening or closing correctly, false detections, or sudden stops. Identifying and rectifying these malfunctions requires skilled technicians and timely troubleshooting.

Maintenance and reliability issues can influence the door system perception among bus operators and transit authorities. If concerns about system reliability and maintenance requirements persist, it may create hesitation or resistance towards adopting or expanding the bus door system. This can hinder market growth and slow down the adoption rate of the automatic bus door system.

Autonomous vehicles are equipped with more than 50 sensors to improve safety and efficiency during operation. These sensors, including LiDAR, RADAR, and cameras, are mounted throughout these vehicles and contribute to forming a safety perimeter.

These sensors can identify any obstruction that approaches the vehicle promptly. Nonetheless, these sensors are not inexpensive. A long-range LiDAR of good quality can cost up to USD 75,000. In addition to the hardware cost, these vehicles require software to retrieve sensor data for control purposes.

Therefore, the production of vehicles and the large-scale deployment of self-driving buses with expensive gear offer significant hurdles for manufacturers. Thus, it is projected that the high production cost of self-driving buses will impede the expansion of autonomous bus door system trends.

| Report Metric | Details |

|---|---|

| Segmentations | |

| By Bus Type |

Shuttle Bus City Bus Intercity Bus |

| By Bus Door Type |

Folding Sliding Plug |

| By Propulsion Type |

ICE Electric |

| Key Players |

|

| Geographies Covered | |

| North America |

U.S. |

| Europe |

U.K. |

| Asia Pacific |

China |

| Middle East & Africa |

Saudi Arabia |

| Latin America |

Brazil |

The city bus segment is expected to dominate the market throughout the forecast period. Cities are experiencing rapid urbanization, leading to increased population density. As cities become more crowded, the demand for efficient and sustainable public transportation options, including buses, grows.

City buses provide a convenient and cost-effective mode of transportation for residents and commuters. Countries like China and India face significant congestion and air pollution challenges.

City buses solve these problems by reducing the number of private vehicles on the road. As governments and city planners prioritize sustainable transportation solutions, the demand for city buses rises.

The growth of articulated bus segment is also anticipated to grow at a significant growth rate. Articulated buses are known for their larger passenger capacity compared to standard buses.

These buses can accommodate more passengers, making them suitable for high-demand routes in densely populated areas or during peak hours. With increased passenger capacity, there is a corresponding need for efficient and reliable bus doors to ensure smooth boarding and alighting processes.

The demand for articulated buses, which are longer buses with flexible joints in the middle, can impact the demand for bus doors, including automatic bus door systems.

The shuttle bus segment was the highest contributor to the market and is estimated to grow at a CAGR of 41.7% during the forecast period. Shuttle buses are any bus service intended primarily to shuttle passengers between fixed locations.

Generally, shuttle buses are operated between short and medium journeys. A shuttle bus runs between two or more places regularly. The airport shuttle bus is an example of the same. These autonomous shuttle buses have applications on private roads, airports, and other places.

For instance, New York city’s first self-driving shuttle service is now open for business, and Optimus ride operates six autonomous shuttles on private roads in Brooklyn.

Further, an autonomous shuttle bus has started making trips at Brussels airport. The test rides are carried out without passengers as of now; to test the technology. The concept of connected mobility is opportunistic for market expansion.

The folding door segment dominated the market in 2024. Folding doors open inward and folding to the side can help optimize space within the bus. This allows for efficient passenger flow and maximizes the available interior space.

Adopting folding doors on electric buses can drive the demand for automatic bus door systems, encouraging bus manufacturers, operators, and suppliers to invest in and further develop these technologies.

The market growth potential is further enhanced as more cities and governments prioritize electric buses as part of their sustainable transportation initiatives.

The market is projected to be dominated by sliding plug doors during the forecast period, primarily due to their superior sealing capacity and minimal obstruction. The larger opening of these doors enables passengers to enter and exit buses smoothly without encountering any obstacles.

Sliding doors are designed for low-floor buses and are expected to prove beneficial in BRT buses. The door can be operated on hydraulic and pneumatic door pumps. Sliding doors have the best airtightness and are helpful in the winter and rainy seasons.

The ICE segment held the leading market share in 2024 due to high production and on-road fleet of the conventional fuel buses. Many public transportation agencies and private bus operators periodically renew and expand their fleets to replace older vehicles and accommodate increasing passenger demand.

This drives the demand for new buses equipped with doors, contributing to the growth of the ICE segment market. The electric bus market is expected to show rapid growth during the forecast period. According to the United Nations Environment Program (UNEP) report, urban buses account for one of the significant shares of air pollution.

To develop fast and low-emission transportation, UNEP offers technical support in 20 cities in Asia, Africa, and Latin America. Such government initiatives are expected to boost the demand for electric buses during the forecast period.

Asia Pacific region dominated the automatic bus door system market share in 2024. Asia Pacific is undergoing rapid urbanization, with many cities and towns expanding their transportation networks. This has propelled the demand for public transportation systems, including buses equipped with automatic doors.

As the countries in the Asia Pacific region continue to develop, there is a rise in disposable income among the population. This has resulted in increased mobility and a higher demand for comfortable and convenient modes of transportation, such as buses with automatic doors. The increasing demand for public transport is a significant factor fueling the market growth in the region.

Europe is the second-largest region. It is estimated to reach an expected value of USD 84 million by 2033, registering a CAGR of 44.8%.

Investment by governments of various countries for the development of self-driving buses and the launch of driverless buses on roads of different countries for public transport boost the growth of the self-driving bus market in Europe.

Automobile giants in this region are demonstrating a new range of self-driving buses for selected public roads.

For instance, Stagecoach, a transportation group, Alexander Dennis, a bus building company, and Fusion Processing Ltd., an autonomous driving technology provider, have demonstrated Europe’s first full-sized autonomous bus.

North America was the highest revenue contributor and is estimated to grow at a CAGR of 40.8%. The North American region includes countries such as the U.S., Canada, and Mexico.

The launch of a new range of self-driving buses on roads to offer transportation services to passengers and government initiatives for the development of driverless buses are anticipated to propel the growth of the self-driving bus market in North America.

Leading bus manufacturers are launching autonomous technology programs to develop and deploy self-driving buses. For instance, Flyer, a bus manufacturer, has launched an autonomous technology program to deploy driver-assist and self-driving technology for public transit agencies.

The market is expected to grow CAGR of 44 % from 2025 to 2033.

The current market size is USD 17.92 B7illions in 2024.

North America currently holds the largest market shares.

Some of the top industry players in Autonomous Bus Door System Market are, KBT GmbH, Bode Sud S.p.A., Circle Bus Door Systems Co. Ltd., Masats LLC, PSV Transport Systems Ltd., Shavo Norgren (India) Pvt. Ltd., Transport Door Solutions Ltd., Vapor Bus International, Ventura Systems CV, Schaltbau Holding AG., etc.

1.1 Summary

1.2 Research methodology

2.1 Research Objectives

2.2 Market Definition

2.3 Limitations & Assumptions

2.4 Market Scope & Segmentation

2.5 Currency & Pricing Considered

3.1 Drivers

3.2 Geopolitical Impact

3.3 Human Factors

3.4 Technology Factors

4.1 Porters Five Forces Analysis

4.2 Value Chain Analysis

4.3 Average Pricing Analysis

4.4 M & A, Agreements & Collaboration Analysis

5.1 Automatic Bus Door System Market, By Bus Type

5.1.1 Introduction

5.1.2 Market Size & Forecast

5.2 Automatic Bus Door System Market, By Bus Door Type

5.3 Automatic Bus Door System Market, By Propulsion Type

6.1 North America Automatic Bus Door System Market , By Country

6.1.1 Automatic Bus Door System Market, By Bus Type

6.1.2 Automatic Bus Door System Market, By Bus Door Type

6.1.3 Automatic Bus Door System Market, By Propulsion Type

6.2 U.S.

6.2.1 Automatic Bus Door System Market, By Bus Type

6.2.2 Automatic Bus Door System Market, By Bus Door Type

6.2.3 Automatic Bus Door System Market, By Propulsion Type

6.3 Canada

7.1 U.K.

7.2 Germany

7.3 France

7.4 Spain

7.5 Italy

7.6 Russia

7.7 Nordic

7.8 Benelux

7.9 The Rest of Europe

8.1 China

8.2 South Korea

8.3 Japan

8.4 India

8.5 Australia

8.6 Taiwan

8.7 South East Asia

8.8 The Rest of Asia-Pacific

9.1 UAE

9.2 Turkey

9.3 Saudi Arabia

9.4 South Africa

9.5 Egypt

9.6 Nigeria

9.7 Rest of MEA

10.1 Brazil

10.2 Mexico

10.3 Argentina

10.4 Chile

10.5 Colombia

10.6 Rest of Latin America

11.1 Global Market Share (%) By Players

11.2 Market Ranking By Revenue for Players

11.3 Competitive Dashboard

11.4 Product Mapping