Surface Disinfectant Market

Surface Disinfectant Market & Trends Analysis Report, By Type (Alcohol-Based Disinfectants, Quaternary Ammonium Compounds (QACs), Hydrogen Peroxide & Hypochlorite), By Form (Liquid Disinfectants – Dominant Market Share, Wipes and Sprays – Fastest-Growing Segments), By Application (Healthcare – Leading Application Segment, Commercial and Institutional Use, Residential Sector)– Industry Analysis Report, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast, 2025–2033.

Historical Period: 2019-2024

Forecast Period: 2025-2033

Report Code :

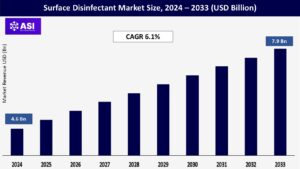

CAGR: 6.1%

Last Updated : February 2, 2026

The global Surface Disinfectant Market was valued at approximately USD 4.6 billion in 2024, and is projected to reach USD 7.9 billion by 2033, growing at a CAGR of 6.1% during the forecast period (2025–2033).

Surface disinfectants are widely used in healthcare, households, and public spaces to prevent the spread of infectious diseases. The rising prevalence of healthcare-associated infections (HAIs), increasing hygiene awareness post-COVID-19, and expanded hospital infrastructure are key growth drivers.

great efficacy surface disinfectants are in great demand due to the rising incidence of healthcare-associated infections (HAIs) in clinical and hospital settings. Hospitals are implementing strict sanitization procedures as infection control becomes a top concern, particularly in developing nations with growing healthcare systems.

As a result of this tendency, disinfectants based on chlorine, alcohol, and quaternary ammonium are increasingly being used in operating rooms, intensive care units, and general wards.

A longlasting change in hygiene practices in residential, commercial, and institutional contexts has been brought about by the COVID-19 epidemic.

Surface disinfection procedures are being strengthened in corporate offices, educational institutions, transit facilities, and hospitality places due to the ongoing emphasis on cleanliness placed by both public health organizations and commercial businesses. Product adoption across a range of end-use sectors is being further accelerated by ongoing public awareness initiatives and regulatory endorsements.

When applied widely or incorrectly, a number of disinfectant formulations—especially those based on phenolics and hypochlorites—have been linked to possible health risks and environmental harm. While inappropriate disposal can contaminate ecosystems, prolonged exposure can cause irritation of the skin and respiratory system.

Regulatory agencies including the European substances Agency (ECHA) and the U.S. Environmental Protection Agency (EPA) have responded by enacting stringent rules for the acceptable use, labeling, and disposal of these substances. Adoption of products may be restricted by such governmental scrutiny, especially in industries with stringent environmental standards.

The manufacturing of surface disinfectants heavily relies on essential raw materials such as hydrogen peroxide, ethanol, and isopropanol. The costs and accessibility of these inputs might vary greatly during times of global upheaval, such as pandemics, trade restrictions, or geopolitical wars.

In addition to impacting production continuity, this instability raises manufacturing costs, lowers profit margins, and puts pressure on prices throughout the supply chain.

| Report Metric | Details |

|---|---|

| Segmentations | |

| By Type |

Alcohol-Based Disinfectants – Largest Segment Quaternary Ammonium Compounds (QACs) Hydrogen Peroxide & Hypochlorite |

| By Form |

Liquid Disinfectants – Dominant Market Share Wipes and Sprays – Fastest-Growing Segments |

| By Application |

Healthcare – Leading Application Segment Commercial and Institutional Use Residential Sector |

| Key Players |

|

| Geographies Covered | |

| North America |

U.S. |

| Europe |

U.K. |

| Asia Pacific |

China |

| Middle East & Africa |

Saudi Arabia |

| Latin America |

Brazil |

The Surface Disinfectant Market is segmented by Function (Acidulant, Emulsifier, Diuretic), By End-Use (Food & Beverage, Pharmaceuticals, Personal Care, Industrial).

Each factor plays a crucial role in enhancing patient safety, increasing the adoption of self-administered anticoagulant therapies, and supporting the development of more convenient, prefilled drug delivery systems that streamline treatment in the management of thromboembolic and cardiovascular conditions.

Alcohol-Based Disinfectants – Largest Segment

These products (including ethanol and isopropanol) are widely used due to their fast action and broad microbial coverage. Preferred in both healthcare and consumer markets.

Quaternary Ammonium Compounds (QACs)

Popular in non-critical healthcare environments and institutional cleaning. QACs provide residual antimicrobial activity but face scrutiny over potential resistance.

Hydrogen Peroxide & Hypochlorite

Strong oxidizing agents used in hospitals, laboratories, and food processing. Their use is rising, but toxicity and material compatibility limit broader adoption.

Preferred for bulk disinfection in hospitals and industry. Liquids offer versatility but require dilution and proper training for use.

Wipes and Sprays – Fastest-Growing Segments

Convenient for household and commercial use. Post-pandemic behavioral shifts have boosted demand for on-the-go formats.

Healthcare – Leading Application Segment

Hospitals and diagnostic centers drive significant consumption due to stringent sanitation standards. Operating rooms, ICUs, and patient wards use a wide range of disinfectant types.

Commercial and Institutional Use

Schools, hotels, retail spaces, and corporate offices are increasingly adopting routine surface disinfection protocols to ensure safety compliance.

Residential Sector

The home care segment has grown considerably, with consumers regularly using sprays and wipes for furniture, kitchen, and bathroom surfaces.

Held over 30% of the market share in 2024. The U.S. leads due to advanced healthcare systems, a mature infection control ecosystem, and high per capita expenditure on hygiene products.

Accounts for around 27% of the market. Germany, France, and the UK are key players. Regulatory standardization, product innovation, and green disinfection products are gaining momentum.

Expected to grow at the highest CAGR of 7.4% through 2033. Rising hospital capacities in India and China, government sanitation programs, and rapid urbanization are driving demand.

Expanding at a moderate pace. Brazil and Mexico are key consumers, supported by a growing private hospital network and retail distribution channels.

Increasing demand from UAE, Saudi Arabia, and South Africa, supported by medical tourism and public hygiene programs.

USD 4.6 billion in 2024.

6.1%

Asia-Pacific with a CAGR of 7.4%.

Healthcare, residential, commercial, and industrial cleaning.

3M, Clorox, Ecolab, Reckitt Benckiser, STERIS, and GOJO Industries.

1.1 Summary

1.2 Research methodology

2.1 Research Objectives

2.2 Market Definition

2.3 Limitations & Assumptions

2.4 Market Scope & Segmentation

2.5 Currency & Pricing Considered

3.1 Drivers

3.2 Geopolitical Impact

3.3 Human Factors

3.4 Technology Factors

4.1 Porters Five Forces Analysis

4.2 Value Chain Analysis

4.3 Average Pricing Analysis

4.4 M & A, Agreements & Collaboration Analysis

5.1 Surface Disinfectant Market, By Type

5.1.1 Introduction

5.1.2 Market Size & Forecast

5.2 Surface Disinfectant Market, By Form

5.3 Surface Disinfectant Market, By Application

6.1 North America Surface Disinfectant Market , By Country

6.1.1 Surface Disinfectant Market, By Type

6.1.2 Surface Disinfectant Market, By Form

6.1.3 Surface Disinfectant Market, By Application

6.2 U.S.

6.2.1 Surface Disinfectant Market, By Type

6.2.2 Surface Disinfectant Market, By Form

6.2.3 Surface Disinfectant Market, By Application

6.3 Canada

7.1 U.K.

7.2 Germany

7.3 France

7.4 Spain

7.5 Italy

7.6 Russia

7.7 Nordic

7.8 Benelux

7.9 The Rest of Europe

8.1 China

8.2 South Korea

8.3 Japan

8.4 India

8.5 Australia

8.6 Taiwan

8.7 South East Asia

8.8 The Rest of Asia-Pacific

9.1 UAE

9.2 Turkey

9.3 Saudi Arabia

9.4 South Africa

9.5 Egypt

9.6 Nigeria

9.7 Rest of MEA

10.1 Brazil

10.2 Mexico

10.3 Argentina

10.4 Chile

10.5 Colombia

10.6 Rest of Latin America

11.1 Global Market Share (%) By Players

11.2 Market Ranking By Revenue for Players

11.3 Competitive Dashboard

11.4 Product Mapping