Polypropylene Market

Polypropylene Market & Trends Analysis Report, By Type (Homopolymer, Copolymer), By Application (Packaging, Automotive, Building & Construction, Electrical & Electronics, Medical), By End Use (Products for Final Consumption, Produzierend, Medical Care)– Industry Analysis Report, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast, 2025–2033.

Historical Period: 2019-2024

Forecast Period: 2025-2033

Report Code :

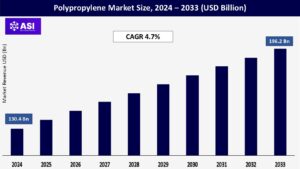

CAGR: 4.7%

Last Updated : February 2, 2026

The global Polypropylene Market size was valued at approximately USD 130.4 billion in 2024 and is projected to reach USD 196.2 billion by 2033, growing at a CAGR of 4.7% during the forecast period. Polypropylene (PP), a versatile thermoplastic polymer, is widely used across industries due to its excellent chemical resistance, durability, low density, and cost-effectiveness.

Growth is driven by expanding demand in packaging, automotive, consumer goods, and medical devices, coupled with increasing use of recyclable and lightweight polymers.

In the packaging industry, polypropylene (PP) is essential and is extensively used to manufacture films, containers, caps, and closures. A major factor in the consumption of PP is the growing need for packaging that is lightweight and flexible—especially in the e-commerce, food & beverage, and personal care sectors.

Furthermore, the increasing consumer awareness and preference for sustainable, recyclable packaging solutions are bolstering polypropylene’s status as a favorable alternative to materials such as PVC.

The automotive sector’s continuous drive to reduce vehicle weight in order to enhance fuel efficiency and comply with strict emissions regulations is greatly increasing the use of polypropylene.

PP is widely employed in the production of automotive parts like bumpers, dashboards, and battery housings because of its superior strength-to-weight ratio. Moreover, due to its excellent resistance to impact and chemicals as well as its thermal stability, the fast-expanding electric vehicle (EV) sector is broadening prospects for PP.

Despite its recyclability, polypropylene is frequently examined for its contribution to plastic waste build-up and marine contamination—especially in areas lacking adequate recycling systems. Manufacturers are being driven to investigate more sustainable options due to environmental worries and the increasing strictness of regulations, particularly in Europe and North America.

This encompasses investments in bio-based polypropylene and circular economy practices designed to minimize the environmental impact of plastic products.

Since polypropylene is made from petroleum based feedstocks such as propylene, the costs associated with its production are very sensitive to changes in crude oil prices. This volatility is driven by geopolitical instability, disruptions in supply chains, and shifts in global energy demand.

Manufacturers can face considerable difficulties due to these unpredictable fluctuations in raw material costs, as they can tighten profit margins and affect the planning of long-term production.

| Report Metric | Details |

|---|---|

| Segmentations | |

| By Type |

Homopolymer Copolymer |

| By Application |

Packaging Automotive Building & Construction Electrical & Electronics Medical |

| By End-Use |

Products for Final Consumption Produzierend Medical care |

| Key Players |

|

| Geographies Covered | |

| North America |

U.S. |

| Europe |

U.K. |

| Asia Pacific |

China |

| Middle East & Africa |

Saudi Arabia |

| Latin America |

Brazil |

The Polypropylene Market is segmented by Type (Homopolymer, Copolymer), By Application (Packaging, Automotive, Building & Construction, Electrical & Electronics, Medical), By End Use (Products for Final Consumption, Produzierend, Medical Care).

Each factor plays a crucial role in enhancing patient safety, increasing the adoption of self-administered anticoagulant therapies, and supporting the development of more convenient, prefilled drug delivery systems that streamline treatment in the management of thromboembolic and cardiovascular conditions.

Homopolymer (Dominant Segment)

Polypropylene homopolymer is the most widely used type, known for its superior stiffness, tensile strength, and versatility. It is extensively utilized in rigid packaging, textiles, household products, and various consumer goods. Its excellent processability makes it especially suitable for injection molding, thermoforming, and film applications, solidifying its dominance in the global market.

Copolymer

Polypropylene copolymer offers enhanced impact resistance and flexibility compared to its homopolymer counterpart. These properties make it ideal for use in automotive components, piping systems, medical devices, and durable consumer products. With rising demand in sectors like healthcare, infrastructure, and transportation, the copolymer segment is witnessing steady growth and increasing application diversity.

Packaging (Largest Market)

The packaging sector represents the largest share of polypropylene consumption, driven by its widespread use in food containers, bags, films, and bottle caps. Polypropylene’s lightweight nature, excellent sealing properties, and high clarity make it ideal for both flexible and rigid packaging solutions. Its recyclability also aligns with growing consumer and regulatory demand for sustainable packaging materials.

Automotive

Polypropylene is extensively used in automotive applications such as interior trims, bumpers, and under-the-hood components. Its lightweight characteristics contribute to vehicle weight reduction, improving fuel efficiency and reducing emissions. Additionally, its chemical resistance and durability ensure reliable performance under extreme operating conditions.

Building & Construction

In the construction industry, polypropylene is used in applications like piping systems, insulation materials, roofing membranes, and geotextiles. Its resistance to moisture, chemicals, and corrosion, combined with cost-effectiveness, is driving demand—especially in developing regions experiencing rapid infrastructure development.

Electrical & Electronics

Polypropylene’s excellent electrical insulation properties, high dielectric strength, and heat resistance make it suitable for use in capacitors, cable insulation, and appliance components. With the growing penetration of consumer electronics and smart appliances, PP is playing a vital role in ensuring product safety and efficiency.

Medical

Polypropylene is widely used in the medical field for products such as syringes, IV bottles, vials, and surgical instruments. Its biocompatibility, sterility, and resistance to autoclaving (high-temperature sterilization) make it ideal for healthcare applications. Rising healthcare investments and improved access to medical services globally are further fueling demand for medical-grade PP.

Products for Final Consumption

In the consumer goods industry, polypropylene is extensively used to produce household items, furniture, textiles, and reusable containers. Its long-lasting nature, versatile appearance, and affordability make it a favored choice for everyday items.

Produzierend

In industrial contexts, PP is used to manufacture storage containers, parts for machinery, and agricultural implements. Its resistance to chemicals, impact, and severe environmental conditions guarantees long-term performance and dependability in challenging environments.

Medical care

Polypropylene is employed in the healthcare sector for a variety of both disposable and reusable items, including medical syringes, specimen containers, and lab equipment. Its sterility, safety, and compatibility with sterilization processes contribute to its growing use in medical applications.

The global polypropylene market is dominated by the Asia Pacific region, with significant contributions from China, India, Japan, and South Korea. The swift industrialization of the region, along with urban growth and the flourishing automotive and packaging industries, are major factors behind the demand for polypropylene.

China stands out in both production and consumption because of its extensive manufacturing infrastructure and increasing domestic demand. Additionally, the area profits from affordable production and a rise in investments related to downstream plastic processing.

The polypropylene market in North America is driven by established sectors like automotive, packaging, and healthcare. Fueled by technological progress in polypropylene recycling and innovations in biobased alternatives, the United States continues to be a prominent player. The regional market growth is bolstered by a heightened focus on sustainability and the rise of industrial applications.

The demand for polypropylene in Europe is significantly affected by environmental regulations that encourage the use of recyclable and sustainable materials. There is a growing influx of investments in the region targeting the development of circular economy models for polypropylene production.

The leading markets, especially for high-performance applications like medical devices, automotive components, and precision packaging, are Germany, France, and the UK.

These developing areas are progressively broadening their polypropylene presence, aided by the growth of infrastructure, urbanization, and industrial advancement. Countries such as Brazil, Mexico, Saudi Arabia, and the UAE are experiencing a rise in demand across the construction, automotive, and consumer goods sectors.

The market potential in these regions is significant due to increasing investments and supportive government initiatives, even though they are still in a developmental phase.

USD 130.4 billion

4.7%

Homopolymer type in the Packaging application

Asia-Pacific, driven by industrial expansion and consumer demand

1.1 Summary

1.2 Research methodology

2.1 Research Objectives

2.2 Market Definition

2.3 Limitations & Assumptions

2.4 Market Scope & Segmentation

2.5 Currency & Pricing Considered

3.1 Drivers

3.2 Geopolitical Impact

3.3 Human Factors

3.4 Technology Factors

4.1 Porters Five Forces Analysis

4.2 Value Chain Analysis

4.3 Average Pricing Analysis

4.4 M & A, Agreements & Collaboration Analysis

5.1 Polypropylene Market, By Type

5.1.1 Introduction

5.1.2 Market Size & Forecast

5.2 Polypropylene Market, By Application

5.3 Polypropylene Market, By End-Use

6.1 North America Polypropylene Market , By Country

6.1.1 Polypropylene Market, By Type

6.1.2 Polypropylene Market, By Application

6.1.3 Polypropylene Market, By End-Use

6.2 U.S.

6.2.1 Polypropylene Market, By Type

6.2.2 Polypropylene Market, By Application

6.2.3 Polypropylene Market, By End-Use

6.3 Canada

7.1 U.K.

7.2 Germany

7.3 France

7.4 Spain

7.5 Italy

7.6 Russia

7.7 Nordic

7.8 Benelux

7.9 The Rest of Europe

8.1 China

8.2 South Korea

8.3 Japan

8.4 India

8.5 Australia

8.6 Taiwan

8.7 South East Asia

8.8 The Rest of Asia-Pacific

9.1 UAE

9.2 Turkey

9.3 Saudi Arabia

9.4 South Africa

9.5 Egypt

9.6 Nigeria

9.7 Rest of MEA

10.1 Brazil

10.2 Mexico

10.3 Argentina

10.4 Chile

10.5 Colombia

10.6 Rest of Latin America

11.1 Global Market Share (%) By Players

11.2 Market Ranking By Revenue for Players

11.3 Competitive Dashboard

11.4 Product Mapping