Asia Pacific Plasmapheresis Machines Market

Asia Pacific Plasmapheresis Machines Market Share & Trends Analysis Report, By Product (Centrifugal Plasmapheresis Devices, Membrane Plasmapheresis Devices, Blood Collection Sets, Plasmapheresis Kits, Filters & Separation Devices) By Application (Source Plasma Collection, Therapeutic Plasmapheresis, Neurological Disorders, Hematologic Disorders, Autoimmune Disorders, Others) By End User (Blood Collection Centers, Hospitals & Clinics, Research Institutes) Industry Analysis Report, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast, 2025–2033.

Historical Period: 2019-2024

Forecast Period: 2025-2033

Report Code :

CAGR: 7.8%

Last Updated : August 13, 2025

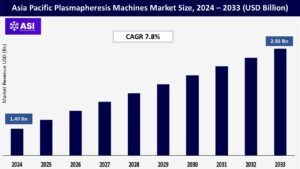

The global Asia Pacific Plasmapheresis Machines Market was valued at approximately USD 1.49 billion in 2024 and is projected to reach USD 2.93 billion by 2033, growing at a CAGR of 7.8% during the forecast period (2025–2033).

Plasmapheresis machines are specialized medical devices used to separate plasma from whole blood to both provide therapeutic treatment and to provide excellent plasma donation. The process of plasmapheresis involves taking the patient’s blood, separating the plasma from whole blood utilizing either centrifugation or membrane filtration technologies, and then returning the whole blood back to the patient. Connecting the two, plasmapheresis can be used for therapeutic purposes for patients with autoimmune diseases, neurological diseases, or other blood related conditions as it removes anti-bodies or toxins from the plasma during the process of plasmapheresis. In blood donation facilities plasmapheresis machines are effective tools for plasma donation which can be utilized in the pharmaceutical industry to produce plasma derived therapies or technologies.

The increase find and burden of autoimmune and neurological diseases including Guillain-Barré Syndrome (GBS), Myasthenia Gravis, multiple sclerosis (MS), and systemic lupus erythematosus (SLE) are significant drivers of the growth of the plasmapheresis machines market in Asia Pacific as these conditions often require a plasma exchange (therapeutic plasmapheresis) to remove circulating autoantibodies and inflammatory mediators from the blood to elicit rapid temporary symptomatic relief along with an improvement in clinical outcomes.

As per the report released by the Asia Pacific Neurological Association (2023), the cases of autoimmune neurological diseases in India, Japan, and South Korea have gone up by over 25% over the last decade. Tertiary centers in India such as AIIMS and Apollo Hospitals have expanded their apheresis capacity due to the increasing number of neurological patients requiring plasma exchanges.

There is increased awareness about early diagnosis, government funding for rare diseases, and the availability of centres capable of providing specialized care that increases access to therapeutic plasmapheresis. Additionally, the increasing availability of artificial intelligence and easy-to-use plasmapheresis machines increases the likelihood of being more widely utilized by neurologists and in intensive care units. As the disease prevalence increases along with diagnostic capacity increases, the number of plasmapheresis performed and thus number of plasmapheresis machines will continue to grow.

Increasing demand for plasma-derived therapies, such as immunoglobulins, clotting factors, and albumin, is one of the key market drivers resulting in adoption of plasmapheresis machines in the Asia Pacific. These therapies are critical in treating disease areas with high unmet need, including primary immunodeficiencies, hemophilia, and liver disease.

Furthermore, increasing healthcare accessibility, diagnostic advancement, and aging population demographics is rapidly increasing demand for these biologics. CSL Behring, a top manufacturer of plasma products, posits that the Asia Pacific region is one of the fastest-growing markets for immunoglobulin therapies, and accordingly, governments in countries like China, Australia, and Japan are actively investing in plasma collection networks.

For example, Shanghai RAAS announced that it would scale up its domestic plasma collection immensely by deploying highly productive and efficient plasmapheresis machines to help achieve national self-sufficiency goals in 2024. Government policy is also contributing to increased plasma collection activity. China’s National Health Commission enforced regulations which promote and increase rates of plasma donation.

Meanwhile, the National Blood Authority in Australia continues to formalize arrangements with private collection centers to improve local supply of plasma-derived medicines. As these initiatives unfold, consistent and robust adoption of complex plasma collection machines that facilitate higher donor throughput and safety will support the evolving therapeutic requirements of the region.

High costs of equipment, disposables, and procedures are among the primary constraints limiting market growth of the plasmapheresis machines in Asia Pacific. A plasmapheresis machine is a complex medical device and requires a significant capital investment, not to mention the purchase of specific disposables (e.g., filters, tubing sets, anticoagulants) before each procedure. Plasmapheresis procedures can be labor and resource intensive and require trained health professionals, adding to the operational costs.

All of this can make plasmapheresis procedures expensive, which greatly undercuts their growth potential, especially in the under resourced low- and middle- income countries like India, Indonesia, Vietnam, and the Philippines which often have underfunded health care systems and where a significant portion of health services is centralized in urban areas.

For many hospitals and smaller clinics located in rural or tier-2 cities, there is simply insufficient economic justification for investment in plasmapheresis technology resulting in limited availability of plasmapheresis in health facilities. Even in more developed markets like China and Thailand hospitals could be avoiding investing in plasmapheresis services because of low patient volumes and unreliability of reimbursement from payers.

| Report Metric | Details |

|---|---|

| Segmentations | |

| By Product |

Centrifugal Plasmapheresis Devices Membrane Plasmapheresis Devices Blood Collection Sets, Plasmapheresis Kits Filters & Separation Devices

|

| By Application |

Source Plasma Collection Therapeutic Plasmapheresis Neurological Disorders Hematologic Disorders Autoimmune Disorders Others |

| By End User |

Blood Collection Centers Hospitals & Clinics Research Institutes |

| Key Players |

|

| Geographies Covered | |

| Asia Pacific |

China |

The Asia Pacific Plasmapheresis Market is segmented by product, application, and end-user. Each segment reflects unique dynamics shaped by expanding plasma donation infrastructure, growing therapeutic demand, and rising adoption of advanced apheresis technologies across the region.

Centrifugal Plasmapheresis Devices accounted for the largest share of the market in 2024, due in part to general efficiency and faster procedure times compared to membrane devices, and their broader applicability in donor and therapeutic plasmapheresis. Centrifugal devices have been heavily utilized in high-volume centers within countries such as China, Japan, and South Korea, where donor throughput and automation are critical factors to meet the growing demand for plasma products.

Membrane Plasmapheresis Devices are a growth sector, particularly for therapeutics, as they preferred as a gentler means of separation to treat patients with autoimmune or hematological disorders. Adoption rates for this technology are growing, particularly in Japan and Australia, supported by strong clinical guidelines and hospital infrastructure. Blood Collection Sets are an important consumable device and represent a significant amount of repeatable revenue for the business.

As independent blood donation programs are expanding in countries (such as India and China), the demand for single-use blood collection sets will increase as there will be more frequency of donors due to government campaigns to raise donations. Plasmapheresis Kits, which include tubing sets and anticoagulant, are increasingly being consumed in fixed and mobile plasmapheresis units. The demand for kits should continue to grow steadily with the expansion of national plasma collection networks.

Source Plasma Collection has emerged as the dominant application area, mostly boosted by the rapid growth in demand for plasma-derived biologicals such as immunoglobulins, albumin, and clotting factors. The ongoing government-led and private sector expansion of donation networks throughout various locales, such as China, India, and Southeast Asia, is a major catalyst for this area of application.

Therapeutic Plasmapheresis is steadily rising in importance, primarily owing to the growing burden of chronic and autoimmune disease. Japan and Australia appear to be leading the way using plasmapheresis as a frontline treatment in their vast tertiary care hospitals supported with a strong sustainability model, funded in the public health system, and promoting clinician training and development.

Neurologic Disorders, including myasthenia gravis and Guillain-Barré syndrome, represent a substantial proportion of therapeutic plasmapheresis procedures. Expansion of screening and diagnostics and increased clinical awareness is contributing to growth in procedure volumes in Japan and South Korea.

Hematologic Disorders, including thrombotic thrombocytopenic purpura (TTP) or hyperviscosity syndromes, are a narrower but growing area of application, especially in urbanize tertiary centers where advanced therapeutic equipment is available. Autoimmune Disorders is a rapidly developing sub-segment in the use of plasmapheresis in situations of lupus and vasculitis. Patient knowledge and clinician buy-in around its use is seen most strongly in countries with well-developed health care sectors, including Australia and South Korea.

Others, including emerging indications such as sepsis, metabolic disease, and transplant-related uses, represent a much smaller segment but are generating momentum both academically and through clinical studies. Countries such as Singapore and Japan are being watch closely for the development in this area.

Blood Collection Centers represent the largest end-user category in 2024 by share of the market. The growth of national plasma collection programs, coupled with the growth of mobile apheresis units in emerging markets such as India and China, will continue to drive this segment. Investments in donor outreach, automatically incorporated collection systems, and regulatory support has enhanced the backbone for plasma procurement in the area.

Hospitals & Clinics are a key end-user segment, particularly for therapeutic plasmapheresis procedures. Major hospitals and tertiary hospitals in Japan, Australia, and South Korea are equipped with independent dedicated apheresis units, and increasing prevalence of autoimmune and neurological diseases that utilize plasmapheresis technologies are contributing to increased clinical use.

Research Institutions are a small, growing subset of the end users, mostly driven by academia and biopharmaceutical institutions engaged in research on plasma proteins, immune response mechanisms, and device development. Strong institutional funding in Japan and South Korea is creating innovation and supporting clinical trials that utilize plasmapheresis.

North America will account for approximately 35.2% of the market in 2024, driven by the presence of advanced healthcare infrastructure, existing plasma donor centers, and greater acceptance rates with therapeutic apheresis. The United States will lead oligopolistically due to its ample plasma collection network facilities with supported reimbursement policies which will grow the demand of plasmapheresis machines in that region.

It has added support with the high incidence and prevalence of autoimmune and neurological disorders. The US is expected to see continued investment in new medical R&D expenditures, and the favourable regulatory climate is conducive to bringing innovative and advanced devices into the market.

Europe will have an estimated share of about 28.4% and is a market unto itself because its generally mature healthcare systems are increasingly in demand for plasma-derived therapies. Nations like Germany, France, and the UK are major contributors to the additional growth in Europe with their extensive donation networks and apheresis facilities.

With an aging population and increased burden of chronic diseases, the need for plasmapheresis machines will grow. Existing government policies that encourage self-sufficiency of plasma supplies, as well as funding for new research into apheresis, create an environment for growth.

Asia Pacific will see positive and fastest growth with the estimated share accounting for about 24.6% market share in 2024. This growth will be driven by the fast pace of urbanization, rapid growth in the rate of healthcare expenditure, and increasing size of the region’s elderly population in countries like China, India, Japan, and Australia.

Construction of plasma collection infrastructure and a growing awareness of autoimmune diseases are huge enablers for growth. The challenge for this region for plasmapheresis will be affordability of the services and accessibility to rural and hard to reach patients limiting overall penetration.

These regions have a combined market share of approximately 11.8%, and they are experiencing moderate growth, attributed to improved healthcare investments and expanded networks of plasma donation.

Economic constraints, limited healthcare infrastructure, and limited access to advanced technology limit adoption in the regions. On the other hand, plasma collection improvement and more awareness about plasmapheresis are developing, providing opportunity for growth for the future.

The Asia Pacific Plasmapheresis Machines market was valued at USD 1.49 billion in 2024.

The market is projected to grow at a CAGR of 7.8% from 2025 to 2033.

Centrifugal Plasmapheresis devices hold the largest market share.

The Asia-Pacific region is expected to witness the highest growth rate.

Major players include Terumo Corporation, Haemonetics Corporation and Fresenius Kabi AG.

1.1 Summary

1.2 Research methodology

2.1 Research Objectives

2.2 Market Definition

2.3 Limitations & Assumptions

2.4 Market Scope & Segmentation

2.5 Currency & Pricing Considered

3.1 Drivers

3.2 Geopolitical Impact

3.3 Human Factors

3.4 Technology Factors

4.1 Porters Five Forces Analysis

4.2 Value Chain Analysis

4.3 Average Pricing Analysis

4.4 M & A, Agreements & Collaboration Analysis

5.1 China

5.2 Japan

5.3 India

5.4 South Korea

5.5 Australia

5.6 Taiwan

5.7 Rest of APAC

6.1 Global Market Share (%) By Players

6.2 Market Ranking By Revenue for Players

6.3 Competitive Dashboard

6.4 Product Mapping