Automotive Alloy Wheel Market

Automotive Alloy Wheel Market Size, Market Share & Trends Analysis Report By Vehicle Type (Two-Wheeler, Passenger Vehicle, Light Commercial Vehicle, Truck, Bus & Coach), By Finishing Type (Powder Coated/Painted Lacquered, Diamond Cut, Split Wheel, Chrome Wheel, Anodized, Others), By Rim Size (12″-17″, 18″-21″, More Than 22″), By Material Type (Aluminum Alloy, Titanium Alloy, Magnesium Alloy, Others), By Sales Channel (OEM, Aftermarket) – Industry Analysis Report, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast, 2026–2033

Historical Period: 2019-2024

Forecast Period: 2025-2033

Report Code : ASIATR1002

CAGR: 7.8%

Last Updated : April 20, 2025

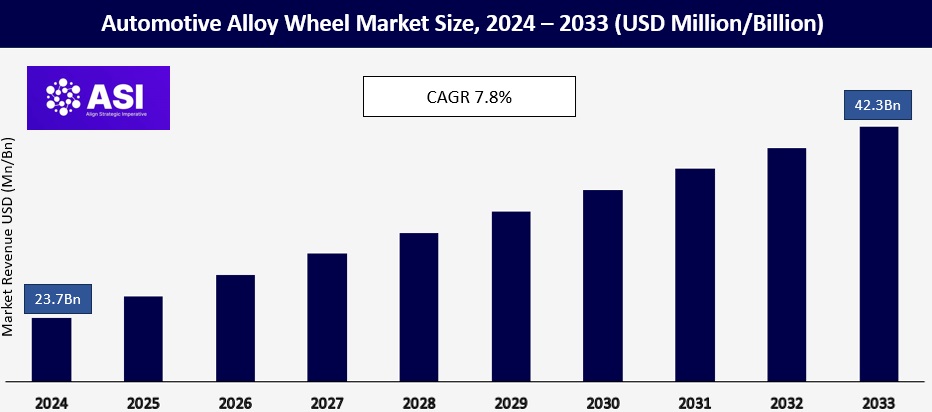

The global Alloy Wheel Market Size was valued at approximately USD 23.7 billion in 2024 and is expected to reach USD 42.3 billion by 2033, growing at a CAGR of 7.8% during the forecast period (2026–2033). The increasing Car Alloy Wheels Demand is primarily driven by growing consumer preference for aesthetically appealing and lightweight wheels that enhance vehicle performance and fuel efficiency. The Automotive Wheel Market Analysis highlights the surge in demand for Alloy Wheels for Cars, driven by their superior durability, corrosion resistance, and improved heat dissipation properties.

The Alloy Wheel Market Growth is further fueled by advancements in Alloy Wheel Manufacturers’ production technologies, increasing automotive sales, and rising customization trends in the Automotive Wheel Industry Trends. Moreover, stringent government regulations promoting fuel efficiency and reduced emissions are propelling the adoption of lightweight alloy wheels.

Aesthetic and Performance Enhancement Driving Car Alloy Wheels Demand

The global alloy wheel market is witnessing a surge in demand due to the growing consumer preference for vehicle customization and high-performance wheels. Car owners, particularly in the luxury, sports, and aftermarket segments, are increasingly opting for custom alloy wheels that enhance both the aesthetic appeal and driving dynamics of their vehicles. This trend is fueling the car alloy wheel market size, as manufacturers introduce innovative wheel designs, advanced finishes, and lightweight materials to meet evolving consumer preferences.

The automotive wheel industry trends indicate that car enthusiasts and luxury vehicle owners are increasingly investing in aftermarket alloy wheels to personalize their vehicles. Custom diamond-cut, split-wheel, chrome, and anodized alloy wheels are gaining popularity due to their premium look and enhanced durability. Additionally, powder-coated and painted lacquered wheels are widely chosen for their corrosion resistance and ability to complement different car designs. The rise of social media and online automotive communities has further fueled interest in custom alloy wheels, encouraging consumers to upgrade their factory-fitted wheels with more visually appealing and performance-oriented options.

Beyond aesthetics, alloy wheel market growth is being driven by the increasing adoption of performance-oriented wheels that improve vehicle handling, braking efficiency, and overall driving stability. Unlike traditional steel wheels, aluminum, magnesium, and titanium alloy wheels provide superior strength-to-weight ratios, reducing unsprung weight and enhancing both acceleration and braking responsiveness. These advantages make them a preferred choice for sports cars, high-performance sedans, SUVs, and electric vehicles (EVs).

In motorsports and high-speed driving applications, forged alloy wheels are extensively used due to their higher tensile strength and resistance to deformation. Leading automakers, including Ferrari, Lamborghini, Porsche, and BMW, integrate lightweight, high-performance alloy wheels into their premium vehicle lineups, further increasing the global alloy wheel market forecast.

Growing Aftermarket Sales and OEM Innovations

The aftermarket segment plays a significant role in driving the alloy wheel market size, as consumers look for personalized upgrades beyond standard OEM offerings. Rim sizes above 18 inches are in high demand, especially among SUV and sports car owners seeking aggressive styling and improved cornering stability. Moreover, electric vehicle manufacturers are increasingly incorporating lightweight alloy wheels to maximize battery efficiency and driving range.

On the OEM front, automakers are collaborating with leading alloy wheel manufacturers to develop customized wheels that align with vehicle performance and brand identity. For example, Tesla, Audi, and Mercedes-Benz have introduced aerodynamically optimized alloy wheels in their latest EV and luxury vehicle models, demonstrating the industry’s commitment to innovation and fuel efficiency.

High Costs Associated with Alloy Wheels

Despite their advantages, alloy wheels are more expensive than conventional steel wheels, which may limit their adoption in low-cost and entry-level vehicles. The manufacturing process, including forging, casting, and machining, adds to the overall cost, making them a premium product.

Durability Issues Compared to Steel Wheels

While alloy wheels enhance performance and aesthetics, they are more prone to damage from rough terrains and potholes. Cracks and bends in magnesium and aluminum alloy wheels are more common compared to steel wheels, leading to higher maintenance costs for consumers.

| Report Metric | Details |

|---|---|

| Segmentations | |

| By Vehicle Type |

Two Wheeler Passenger Vehicle

Light Commercial Vehicle Truck Bus & Coach |

| By Finishing Type |

Powder Coated/Painted Lacquered Diamond Cut Split Wheel Chrome Wheel Anodized Others |

| By Rim Size |

12″-17″ 18″-21″ More Than 22″ |

| By Material Type |

Aluminum Alloy Titanium Alloy Magnesium Alloy Others |

| By Sales Channel |

OEM Aftermarket |

| Key Players |

Enkei Corporation Ronal Group BBS Kraftfahrzeugtechnik AG Borbet GmbH OZ Group Topy Industries Limited Foshan Nanhai Zhongnan Aluminum Wheel Co. Ltd Superior Industries International Inc. Maxion Wheels YHI International Limited Alcoa Corporation Others |

| Geographies Covered | |

| North America |

U.S. |

| Europe |

U.K. |

| Asia Pacific |

China |

| Middle East & Africa |

Saudi Arabia |

| Latin America |

Brazil |

The global alloy wheel market is segmented by vehicle type, finishing type, rim size, material type, and sales channel, each contributing significantly to market dynamics and growth trends.

The passenger vehicle segment holds the largest market share, accounting for over 59.4% of the global alloy wheel market in 2024. Increasing consumer demand for lightweight, high-performance alloy wheels for cars is driving growth in sedans, hatchbacks, and utility vehicles. The hatchback sub-segment is witnessing increased adoption of aesthetic and performance-oriented wheels, particularly in emerging markets like India and Brazil. Utility vehicles (SUVs & crossovers) are expected to register the highest CAGR, driven by the rising preference for premium, off-road-capable alloy wheels.

The light commercial vehicle (LCV) segment is gaining traction as fleet owners opt for alloy wheels to improve vehicle efficiency and longevity. The truck and bus & coach segments, while traditionally dominated by steel wheels, are seeing gradual adoption of aluminum alloy wheels due to benefits such as better heat dissipation, reduced weight, and improved fuel economy. The two-wheeler segment is also expanding as motorcycle manufacturers introduce premium, custom-designed alloy wheels to enhance performance and styling.

The powder-coated or painted lacquered alloy wheels segment holds the largest market share of total sales. These wheels are popular due to their durability, corrosion resistance, and cost-effectiveness. Diamond-cut alloy wheels, which provide a premium look and enhanced surface strength, are growing in popularity among luxury and performance car manufacturers, especially in Europe and North America.

The split wheel segment is seeing increasing adoption in high-performance vehicles, as they offer better aerodynamics and weight distribution. Chrome wheels, preferred in markets like the U.S. for their aesthetic appeal, are witnessing demand in the aftermarket sector. Anodized alloy wheels, known for their enhanced resistance to wear and oxidation, are becoming increasingly popular in sports cars and off-road vehicles.

The 12″-17″ rim size segment dominates the market, as these sizes are commonly used in hatchbacks, sedans, and two-wheelers. Growing urbanization and the increasing demand for small and mid-sized passenger cars are fuelling this segment’s growth.

The 18″-21″ segment is expanding rapidly, driven by the rising production of SUVs, crossovers, and sports cars that require larger, high-performance alloy wheels. This segment is expected to register a CAGR of 7.2% during the forecast period. The 22″ and above category is primarily used in luxury SUVs, trucks, and specialty vehicles, with demand increasing in North America and the Middle East, where premium and off-road vehicles are popular.

The aluminum alloy wheels segment accounts for over 68.9% of the global market, driven by the automotive industry’s shift toward lightweight materials. These wheels offer superior fuel efficiency, durability, and cost-effectiveness, making them the preferred choice for mass-market vehicles.

The magnesium alloy wheels segment is gaining traction in high-performance sports cars and motorcycles, as they are 30% lighter than aluminum wheels, providing improved handling and acceleration. However, their higher production costs limit their adoption in the mainstream market. Titanium alloy wheels, though niche, are seeing increasing demand in luxury and racing vehicles, thanks to their exceptional strength-to-weight ratio. The others category, including carbon-fiber-infused alloy wheels, is emerging as an innovative segment, particularly in high-end and concept vehicles.

The OEM (Original Equipment Manufacturer) segment holds xx % of the global alloy wheel market, as most automakers equip their vehicles with factory-fitted alloy wheels to enhance aesthetics, performance, and efficiency. Leading car manufacturers such as BMW, Audi, Mercedes-Benz, and Toyota are increasingly integrating lightweight alloy wheels into their vehicle lineups.

The aftermarket segment is witnessing significant growth, particularly in regions like North America, Europe, and the Middle East, where vehicle customization and performance upgrades are highly popular. Alloy wheel manufacturers catering to the aftermarket sector focus on offering customized, high-performance wheels to consumers seeking aesthetic modifications or replacements. The rising demand for aftermarket alloy wheels in the tuning and motorsport industries is expected to drive the segment’s growth further.

The global alloy wheel market is witnessing significant growth across various regions, with North America, Europe, and Asia-Pacific emerging as dominant players. Each region has distinct market dynamics influenced by economic conditions, regulatory policies, technological advancements, and consumer behavior.

North America holds 31.4% of the global alloy wheel market, driven by high consumer demand for premium vehicles, sports cars, and performance-oriented SUVs. The U.S. and Canada are major contributors, with increasing adoption of lightweight and aesthetically appealing alloy wheels. The aftermarket segment in North America is particularly strong, as vehicle owners frequently opt for custom alloy wheels to enhance aesthetics and performance. The presence of leading alloy wheel manufacturers such as Enkei, BBS, and American Racing supports market growth in the region. Furthermore, stringent fuel efficiency and emission regulations set by the Environmental Protection Agency (EPA) encourage automakers to use lightweight alloy wheels to reduce overall vehicle weight and improve fuel economy. The market is also benefiting from the rise of electric vehicles (EVs), as alloy wheels play a crucial role in enhancing EV efficiency.

Europe is a mature market for automotive alloy wheels, accounting for a significant share due to the strong presence of luxury and performance vehicle manufacturers such as BMW, Audi, Mercedes-Benz, and Ferrari. The demand for high-quality alloy wheels is fueled by the region’s focus on automotive innovation, stringent carbon emission regulations, and growing consumer preference for fuel-efficient vehicles. Countries like Germany, the UK, France, and Italy lead the adoption of advanced alloy wheel technologies, including forged and lightweight aluminum wheels.

The European Union’s push for sustainable mobility solutions is further accelerating the adoption of lightweight alloy wheels in electric and hybrid vehicles. In addition, alloy wheel market growth in Europe is driven by the rising trend of car customization and the increasing number of auto shows and aftermarket exhibitions that promote high-performance wheels. The 18″-21″ rim size segment is particularly popular in sports and luxury cars, while powder-coated and diamond-cut finishes dominate the premium vehicle category.

Asia-Pacific is the fastest-growing region in the automotive wheel industry, with countries like China, Japan, India, and South Korea emerging as key markets. The region’s dominance is driven by high vehicle production, rapid urbanization, rising disposable incomes, and growing demand for fuel-efficient and aesthetically enhanced vehicles. China, the world’s largest automotive market, plays a pivotal role, with increasing sales of passenger vehicles, SUVs, and electric cars. The shift toward lightweight alloy wheels in the electric vehicle sector is a significant growth factor, supported by government initiatives promoting energy-efficient transportation.

India’s market is expanding due to rising vehicle ownership, increasing demand for alloy wheels in mid-segment cars, and a booming automotive aftermarket industry. Japan and South Korea, home to major automakers like Toyota, Honda, Hyundai, and Kia, are leading the adoption of advanced alloy wheel technologies, including magnesium and titanium alloys for high-performance and fuel-efficient vehicles. Additionally, the growing popularity of motorcycles with alloy wheels in countries like Indonesia, Vietnam, and Thailand is further boosting regional market growth. The OEM segment dominates in Asia-Pacific due to large-scale vehicle production, while the aftermarket segment is gaining traction as car owners increasingly seek customization.

The automotive wheel market analysis indicates steady growth in the Middle East & Africa (MEA) region, primarily driven by the luxury car market and off-road vehicle demand. Countries such as the United Arab Emirates (UAE), Saudi Arabia, and South Africa are witnessing increased demand for custom alloy wheels, particularly in the SUV and off-road vehicle segments. The high disposable income of consumers in the Middle East fuels the aftermarket alloy wheels industry, with a strong preference for chrome-finished and diamond-cut wheels.

Government initiatives promoting sustainable transportation solutions, such as Saudi Arabia’s Vision 2030, are also influencing market dynamics, as automakers shift toward lightweight materials to enhance fuel efficiency. In Africa, growing vehicle imports and the rising demand for fuel-efficient cars are supporting the adoption of aluminum alloy wheels. The OEM market in MEA is relatively smaller compared to other regions, but the aftermarket sector is expanding, as consumers seek customized and high-performance wheels to improve their vehicles’ aesthetics and handling.

Latin America is experiencing moderate growth in the alloy wheel market, led by Brazil, Mexico, and Argentina. The demand for car alloy wheels is fueled by the expansion of the automotive manufacturing industry, rising vehicle ownership, and increasing consumer preference for stylish and lightweight wheels. Brazil is a major hub for passenger vehicle production, and the increasing penetration of aluminum alloy wheels in mid-range and premium cars is boosting market growth.

Mexico, being a leading automobile export hub, is witnessing rising adoption of lightweight alloy wheels in both OEM and aftermarket segments. The country’s strong trade relations with North America and Europe further drive alloy wheel exports. The Latin American aftermarket segment is expanding as car owners increasingly opt for performance-enhancing wheels, particularly in the SUV and sedan categories. However, economic fluctuations and currency volatility pose challenges to market expansion in some Latin American countries.

The Global Alloy Wheel Market was valued at USD 23.7 billion in 2024.

The market is projected to grow at a CAGR of 7.8% from 2026 to 2033.

The Passenger Vehicle segment holds the largest market share.

The Asia-Pacific region is expected to witness the highest growth.

Major players include Enkei Corporation, Ronal Group, and BBS Kraftfahrzeugtechnik AG.

1.1 Summary

1.2 Research methodology

2.1 Research Objectives

2.2 Market Definition

2.3 Limitations & Assumptions

2.4 Market Scope & Segmentation

2.5 Currency & Pricing Considered

3.1 Drivers

3.2 Geopolitical Impact

3.3 Human Factors

3.4 Technology Factors

4.1 Porters Five Forces Analysis

4.2 Value Chain Analysis

4.3 Average Pricing Analysis

4.4 M & A, Agreements & Collaboration Analysis

5.1 Automotive Alloy Wheel Market, By Vehicle Type

5.1.1 Introduction

5.1.2 Market Size & Forecast

5.2 Automotive Alloy Wheel Market, By Finishing Type

5.3 Automotive Alloy Wheel Market, By Rim Size

5.4 Automotive Alloy Wheel Market, By Material Type

5.5 Automotive Alloy Wheel Market, By Sales Channel

6.1 North America Automotive Alloy Wheel Market, By Country

6.1.1 Automotive Alloy Wheel Market, By Vehicle Type

6.1.2 Automotive Alloy Wheel Market, By Finishing Type

6.1.3 Automotive Alloy Wheel Market, By Rim Size

6.1.4 Automotive Alloy Wheel Market, By Material Type

6.1.5 Automotive Alloy Wheel Market, By Sales Channel

6.2 U.S.

6.2.1 Automotive Alloy Wheel Market, By Vehicle Type

6.2.2 Automotive Alloy Wheel Market, By Finishing Type

6.2.3 Automotive Alloy Wheel Market, By Rim Size

6.2.4 Automotive Alloy Wheel Market, By Material Type

6.2.5 Automotive Alloy Wheel Market, By Sales Channel

6.3 Canada

7.1 U.K.

7.2 Germany

7.3 France

7.4 Spain

7.5 Italy

7.6 Russia

7.7 Nordic

7.8 Benelux

7.9 The Rest of Europe

8.1 China

8.2 South Korea

8.3 Japan

8.4 India

8.5 Australia

8.6 Taiwan

8.7 South East Asia

8.8 The Rest of Asia-Pacific

9.1 UAE

9.2 Turkey

9.3 Saudi Arabia

9.4 South Africa

9.5 Egypt

9.6 Nigeria

9.7 Rest of MEA

10.1 Brazil

10.2 Mexico

10.3 Argentina

10.4 Chile

10.5 Colombia

10.6 Rest of Latin America

11.1 Global Market Share (%) By Players

11.2 Market Ranking By Revenue for Players

11.3 Competitive Dashboard

11.4 Product Mapping