Bicycle Market

Bicycle Market Size, Share & Trends Analysis Report By Product (Cargo, Hybrid, Road,), By Technology (Electrical, Conventional), By End-User (Men, Women), By Distribution Channel (Offline, Online) market Analysis Report, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast, 2025–2033.

Historical Period: 2019-2024

Forecast Period: 2025-2033

Report Code :

CAGR: 7.2%

Last Updated : February 3, 2026

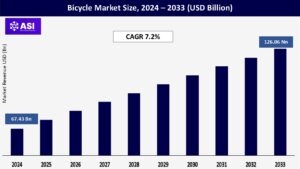

The global bicycle market size was valued at USD 67.43 billion in 2024. It is expected to reach from USD 72.28 billion in 2024 to USD 126.06 billion in 2033, growing at a CAGR of 7.2% over the forecast period (2025-33).

Government initiatives promoting cycling infrastructure, such as bike lanes, bike-sharing programs, and cycling-friendly urban planning, stimulate bicycle use. Policies to reduce pollution and congestion and promote active transportation support market growth.

The global market is driven by the growing preference for bicycles as a convenient form of exercise to ensure a healthy life. People are beginning to understand how important it is to maintain a healthy lifestyle.

They have also begun to understand the benefits of frequent cycling in preventing diseases like obesity. As more and more individuals turn to cycle as a daily exercise, the market is anticipated to expand.

People worldwide have started realizing the importance of staying fit by maintaining a healthy and active lifestyle. As a part of an active lifestyle, people engage in various daily physical activities, including running, bicycling, and exercising in the gym, among others.

The adoption of bicycles has massively increased among people, realizing that regular bicycling is a convenient form of exercise to ensure a healthy life. This can reduce the chances of obesity, cardiovascular diseases, bone-related disorders, and others.

The bicycle market is expected to grow as more people resort to bicycling as a regular form of exercise. Besides exercise, bicycles are gaining popularity for faster daily commuting solutions. The market has witnessed a voluntary shift towards bicycle commuting.

To avoid traffic, people across the world are increasingly adopting bicycles as an alternative way of daily transport, eventually resulting in the growing demand for road bicycles.

Various cycling events are being organized across the globe to create awareness about the benefits of cycling. This, in turn, is boosting the adoption of cycling in daily life as a part of a healthy lifestyle and leisure activities. Along with all the events, participation in various cycling sports is increasing globally.

Cyclocross is one of the notable bicycle sports in the world. It is a form of bicycle racing carried out on a short course featuring grass, pavement, steep hills, wooded trails, and numerous obstacles. Such sports require specially designed road or mountain bicycles, which can withstand rough terrain.

Technological developments in bicycle design enabled the manufacturer to create lightweight and safer sports bicycles. The improvement in overall performance and enhanced safety of cyclocross bicycles has led to various such sports being carried out globally.

Children in the age group of 6 to 17 years are the single largest age demographics of all cyclists, as children in this age group ride bicycle more than any other age group. However, according to the Sports & Fitness Industry Association (SFIA), the number of children who rode a bike regularly has decreased by more than a million from 2014 to 2018 in the U.S.

The bicycle industry is expected to experience a downfall as the demand for children’s bicycles is falling in the U.S., the world’s leading consumer base for the bicycle market. The primary reason for this decreasing demand is the changing lifestyles of kids, who are increasingly spending most of their time on phones, video games, or televisions.

According to the analysis, the global unit sales of children’s bicycles decreased by more than 5% from 2018 to 2019. As a result, many retailers have increased their prices to compensate for the lower consumer demand. The increasing prices of bicycles are also attributed to the unstable political situation between the U.S. and China.

As most of the bikes and their equipment are manufactured in China, the bicycle industry is experiencing difficulties while importing the raw materials as well as fully assembled bicycles. The U.S. The Trump Administration has recently imposed a 25% tariff on around USD 250 billion of Chinese goods, which threatens the entire value chain of the bicycle industry. This value chain includes manufacturers of metal frames, carbon fiber frames, wires, springs, and rubber and metal component providers.

In addition, accessories such as helmets, gloves, lights, and safety guards are also primarily manufactured in China. As a result, the shelf prices of such accessories are also expected to increase over the foreseeable period.

As such, the decreased demand for children’s bicycles, coupled with the Sino-U.S. trade war, is expected to hamper the steady growth of the bicycle market over the forecast period.

| Report Metric | Details |

|---|---|

| Segmentations | |

| By Product Type |

Cargo Hybrid Road |

| By Technology Type |

Electrical Conventional |

| By End-Use Type |

Men Women |

| By Distribution Channel Type |

Offline Online |

| Key Players |

|

| Geographies Covered | |

| North America |

U.S. |

| Europe |

U.K. |

| Asia Pacific |

China |

| Middle East & Africa |

Saudi Arabia |

| Latin America |

Brazil |

The conventional segment held the largest market share in 2024 and is likely to continue its dominance throughout the forecast period. Conventional products are more affordable than e-bikes or other motor vehicles, offering advantages such as low upfront cost, minimal maintenance, and no fuel or electricity requirements.

These benefits are poised to drive market expansion during the forecast period. The electric segment is anticipated to register the fastest CAGR during the forecast period. The growth is attributed to the ability of e-bikes to provide an efficient and convenient solution for urban commuting.

They offer the ability to travel longer distances with less effort, especially in hilly areas, which makes them attractive for commuting to work or running errands. Thus, the accessibility and benefits of e-bikes contribute to the segment growth.

In March 2023, Himiway launched three electric bicycles- Pony, Rambler, and Rhino, which are designed for off-road, daily commutes, and easy riding. This development is poised to drive the growth of the bicycle market during the forecast period.

The hybrid segment held the largest market share in 2024 and is anticipated to continue its dominance during the forecast period. Growing consumer awareness regarding the availability of multi-purpose hybrid products, suitable for daily road commute and hiking activities, is driving their adoption.

In addition, hybrid bikes offer ease of use, comfort, and stability, further boosting their popularity among riders. Hence, the growing adoption of hybrid products is poised to fuel the segment’s growth during the forecast period.

The cargo segment is expected to witness the fastest CAGR during the forecast period. The rapid growth of e-commerce has increased the demand for efficient and flexible delivery options. Cargo products provide a practical solution for small-scale deliveries, allowing businesses to meet the increasing expectation of fast and convenient shipping to customers’ doorsteps.

In October 2023, Addmotor introduced a high-performing electric cargo bike, the GRAOOPRO, with a max load capacity of 500 lbs and a range of 210 miles with its dual battery. The road bicycle segment accounted for the largest market share and is estimated to grow at a CAGR of 8.6% during the forecast period.

The growth is attributed to the fact that road bicycles are basic bikes that do not require any high-end accessories, like those required by mountain, racing, or other special-purpose bikes. The growing trend among people to buy road bicycles with customized features, such as a lightweight and aerodynamic-shaped tube to cut through the wind, is anticipated to boost segment growth.

The men segment held the leading market share in 2024 and is anticipated to retain its position throughout the forecast period, with the fastest growth rate. The men’s segment in the market is influenced by technological advancements and innovations.

Men often seek products with cutting-edge technologies, such as advanced gear systems, lightweight materials, aerodynamic designs, and electronic shifting systems. The appeal of high-performance products that leverage the latest advancements in the bicycle industry drives the demand among male riders.

The women’s segment is expected to witness a considerable growth rate in the coming years. Women value physical fitness and seek ways to incorporate exercise into their daily routines.

Bicycling offers a low-impact form of exercise that promotes cardiovascular health, muscle strength, and overall well-being. Thus, the growing adoption of bicycles by women as a means to stay active and maintain fitness drives the growth of the segment.

The offline segment held the largest market share in 2024. The growth is attributed to the availability of after-sales services such as bike assembly, maintenance, and repairs. This value-added service reassures customers that they can receive assistance and support post-purchase, fostering long-term relationships and repeat business.

The retail shop offers convenience in terms of immediate availability and instant gratification. The high market share is attributable to the increased demand for bicycles at physical stores, which helps customers modify the bikes according to their needs.

Also, it enables customers to get the product instantly. The online segment is anticipated to register the fastest CAGR during the forecast period. The growth is attributed to the online distributor channel overcoming geographical barriers, allowing bicycle enthusiasts from remote areas or regions with limited access to physical stores to explore and purchase products online. This increased accessibility is poised to drive the segment’s growth during the forecast period.

Asia Pacific accounted for the largest market share and is estimated to grow at a CAGR of 8.6%. Countries like China, Japan, and Singapore, among others, strongly emphasize building the infrastructure required to promote and support bicycle commuting.

Some Asian cities, like Tokyo, are renowned for having among the lowest accident rates worldwide, making them prime locations for urban riding.

Additionally, Chinese bike-sharing companies are rapidly expanding their operations in important nations like Australia and India. Bicycle consumption is therefore anticipated to grow over the projection period.

Europe is the second-largest region. It is estimated to reach an expected value of USD 28 billion at a CAGR of 7.5%. Europe contains some cities that are rated ideal for bicycle commuting. The Tour de France and the Ronde van Vlaanderen are among the most well-known cycling competitions held in Europe.

The active construction of bicycle commuting infrastructure by European countries like Belgium, Denmark, France, and Italy significantly boosts the local market.

North America is the third largest region, and Canada’s bicycle market has been continuously growing for decades, as it is considered an effective means of personal transportation.

The bicycle trend is rising due to environmental concerns to decrease CO2 emissions and increase health consciousness. The growing urbanization, sustainability, and congestion are majorly propelling the rising bicycle demand.

Canada exhibits top bicycle manufacturers, including Dorel Industries, Cervelo, and Devinci, with a global presence. Moreover, the trend of e-bikes has a high growth prospect in the country due to a decline in import prices of e-bike components that will eventually boost the market over the forecast period with increasing sales in the country.

The increasing government initiatives to promote bicycles and raise awareness of the benefits of riding bicycles further increase the number of cyclists in Canada. Mountain bicycles can gain significant market share, as the offline distribution channel and retail stores primarily cater to the segment.

The bicycle market is expected to grow CAGR of 7.2 % from 2025 to 2033.

The current bicycle market size is USD 67.43 Billions in 2024.

The Asia Pacific currently holds the largest market share.

Top industry players in Bicycle Market are, Accell Group, Atlas Cycles (Haryana) Ltd, Avon Cycles Limited, Cervelo, Specialized Bicycle Components, Dorel Industries Inc., Giant Bicycles., Merida Industry Co.Ltd Inc., SCOTT Sports SA, Trek Bicycle Corporation, etc.

1.1 Summary

1.2 Research methodology

2.1 Research Objectives

2.2 Market Definition

2.3 Limitations & Assumptions

2.4 Market Scope & Segmentation

2.5 Currency & Pricing Considered

3.1 Drivers

3.2 Geopolitical Impact

3.3 Human Factors

3.4 Technology Factors

4.1 Porters Five Forces Analysis

4.2 Value Chain Analysis

4.3 Average Pricing Analysis

4.4 M & A, Agreements & Collaboration Analysis

5.1 Bicycle Market, By Product Type

5.1.1 Introduction

5.1.2 Market Size & Forecast

5.2 Bicycle Market, By Technology Type

5.3 Bicycle Market, By End-Use Type

5.4 Bicycle Market, By

Distribution Channel Type

6.1 North America Bicycle Market, By Country

6.1.1 Bicycle Market, By Product Type

6.1.2 Bicycle Market, By Technology Type

6.1.3 Bicycle Market, By End-Use Type

6.1.4 Bicycle Market, By Distribution Channel Type

6.2 U.S.

6.2.1 Bicycle Market, By Product Type

6.2.2 Bicycle Market, By Technology Type

6.2.3 Bicycle Market, By End-Use Type

6.2.4 Bicycle Market, By Distribution Channel Type

6.3 Canada

7.1 U.K.

7.2 Germany

7.3 France

7.4 Spain

7.5 Italy

7.6 Russia

7.7 Nordic

7.8 Benelux

7.9 The Rest of Europe

8.1 China

8.2 South Korea

8.3 Japan

8.4 India

8.5 Australia

8.6 Taiwan

8.7 South East Asia

8.8 The Rest of Asia-Pacific

9.1 UAE

9.2 Turkey

9.3 Saudi Arabia

9.4 South Africa

9.5 Egypt

9.6 Nigeria

9.7 Rest of MEA

10.1 Brazil

10.2 Mexico

10.3 Argentina

10.4 Chile

10.5 Colombia

10.6 Rest of Latin America

11.1 Global Market Share (%) By Players

11.2 Market Ranking By Revenue for Players

11.3 Competitive Dashboard

11.4 Product Mapping