Bus Door System Market

Bus Door System Market Share & Trends Analysis Report By Type (Pneumatic, Electric), By Application (School Bus, Commercial Bus), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa) Industry Analysis Report, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast, 2024–2032

Historical Period: 2019-2024

Forecast Period: 2025-2033

Report Code : ASIATR1003

CAGR: 4.5%

Last Updated : April 24, 2025

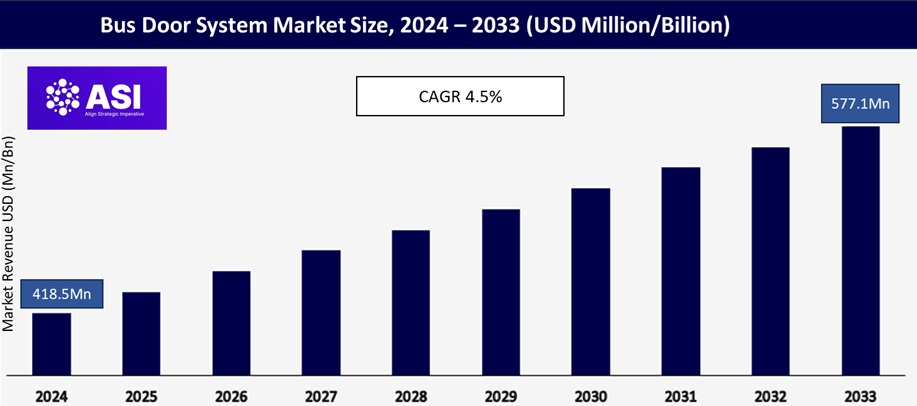

The global Bus Door System Market was valued at approximately USD 418.5 million in 2023 and is projected to reach USD 571.1 million by 2030, growing at a CAGR of 4.5% during the forecast period (2024–2030). Bus door systems are integral components of modern public transportation, enhancing passenger safety, accessibility, and operational efficiency. Increasing demand for automated and semi-automated door solutions, particularly in city buses and intercity transit, is shaping market trends. The adoption of electric bus door systems is rising due to their energy efficiency and reduced maintenance costs, while pneumatic systems remain popular for their durability in high-frequency operations.

Urbanization and Public Transit Expansion

Global urbanization is fueling demand for public transportation, directly impacting the growth of the bus door system market. According to the United Nations, over 56.2% of the world’s population resided in urban areas in 2023, a figure expected to reach 68% by 2050. This urban shift is increasing dependency on efficient, mass-transit systems like buses. Consequently, transit authorities are investing in fleets equipped with automatic door systems to improve boarding efficiency, reduce dwell time, and enhance safety. In India, for example, the Smart Cities Mission is driving the deployment of over 5,595 new buses in Tier-1 and Tier-2 cities, most of which require electronically controlled door mechanisms.

Shift Toward Electric and Autonomous Buses

The shift toward electric mobility is significantly influencing bus component design, including doors. Electric buses accounted for approximately 18% of global new bus sales in 2023. These buses typically integrate electric door systems for energy efficiency, modularity, and ease of integration with battery-powered drivetrains. Furthermore, with over 2,000 autonomous shuttles and buses undergoing pilot testing globally as of 2024, advanced smart door systems that can function without human intervention are becoming critical. These systems include door status feedback, automated emergency release, and integration with vehicle perception systems.

Concerns with Faulty or Inconsistent Performance

Despite advancements in sensor-based automation, bus door systems remain susceptible to mechanical and electrical failures, which can pose safety risks to passengers and drivers. Instances of doors closing on passengers, failing to open in emergencies, or malfunctioning due to harsh weather conditions are major concerns. In colder climates, for example, pneumatic doors can freeze or experience pressure issues, while electric doors may suffer from power disruptions or motor failures. These reliability concerns lead to costly recalls and reduce public confidence in advanced systems, especially in emerging transit markets with limited maintenance infrastructure.

Limited Aftermarket and Retrofit Opportunities

Unlike passenger cars, where aftermarket upgrades are common, the bus door system market has limited penetration in the retrofitting segment. Most transit agencies prefer replacing entire vehicles or systems rather than investing in individual upgrades, especially when warranty or compliance issues are at stake. This limitation reduces recurring revenue potential for door system manufacturers and restricts market growth opportunities to new vehicle sales alone.

| Report Metric | Details |

|---|---|

| Segmentations | |

| By Type |

Pneumatic Electric |

| By Application |

School Bus Commercial Bus |

| Key Players |

Ventura Systems CV Schaltbau Holding AG Masats S.A. Continental AG Rotex Automation Ltd. |

| Geographies Covered | |

| North America |

U.S. |

| Europe |

U.K. |

| Asia Pacific |

China |

| Middle East & Africa |

Saudi Arabia |

| Latin America |

Brazil |

Pneumatic Bus Door Systems

Pneumatic door systems operate using compressed air and are widely recognized for their durability, cost-effectiveness, and minimal electronic complexity. These systems are particularly well-suited for urban and intercity buses in emerging markets, where maintenance infrastructure is still developing. Their robustness makes them ideal for harsh weather conditions and rough road environments. They remain the preferred choice in countries across Southeast Asia, Latin America, and Eastern Europe, where public transport modernization is underway, but cost sensitivity remains high. While demand is steady, the growth rate is relatively slower, projected at a CAGR of 3.1% between 2024 and 2032, as more transit systems transition toward electric and smart door solutions.

Electric Bus Door Systems

Electric door systems are gaining rapid traction due to their precision, automation potential, and compatibility with electric and autonomous buses. These systems use electromechanical actuators, position sensors, and control modules to ensure efficient and smooth operation. They are favored for their lower noise levels, reduced maintenance, and integration with vehicle software systems.

The segment is expected to grow at a CAGR of 7.2% from 2024 to 2032, driven by the rising adoption of zero-emission buses and autonomous public transportation fleets. In markets such as Western Europe, North America, South Korea, and China, electric door systems are becoming standard in newly procured city buses.

School Buses

School buses demand high safety standards, with doors featuring manual override functions, emergency exit compliance, anti-trap sensors, and child-lock mechanisms. This segment is highly regulated, especially in North America and parts of Europe, where specific federal and regional safety codes apply. In the United States alone, over 480,000 school buses operate daily, transporting more than 25 million children, according to the National Association for Pupil Transportation (NAPT). These vehicles rely predominantly on manual and pneumatic door systems due to their simplicity and reliability. Although the school bus segment represented only about 19.4% of the global bus door system market in 2024, it remains crucial from a safety and compliance standpoint. Demand is expected to grow modestly at 3.5% CAGR, with increasing investments in electric school buses supporting a shift toward electric door systems in developed countries.

Commercial Buses

This segment includes city transit buses, long-distance coaches, shuttles, and BRT (Bus Rapid Transit) vehicles, all of which prioritize high-capacity, fast-cycling, and accessible door systems. Commercial buses demand doors that optimize passenger flow, support ADA or equivalent accessibility standards, and minimize vehicle dwell time at stops.

In 2024, commercial buses dominated the bus door system market with a 80.6% share and are expected to maintain this lead through 2032. The increasing number of smart cities, investments in metro bus networks, and growing reliance on intercity bus travel—especially in China, Brazil, Mexico, and India—are fueling this segment.

Commercial buses are also the primary adopters of electric and smart door technologies, with cities like Seoul, London, and Amsterdam deploying fleets equipped with bi-parting, inward-swing, and sliding door systems integrated with smart sensors and AI.

North America holds 22.3% of global bus door system market share. North America remains a key player in the bus door system industry due to its early adoption of advanced transit technologies and strict safety regulations enforced by agencies such as the U.S. Department of Transportation (DOT) and the Federal Transit Administration (FTA). The rise of electric school buses in the United States and Canada is accelerating demand for electric bus door systems. As of 2024, over 6,000 electric school buses were operational across various states, with California leading adoption. Transit agencies in major cities like New York, Los Angeles, and Toronto are also integrating smart door systems with real-time diagnostics and obstacle detection.

Europe’s strong focus on sustainable transportation and emission reduction policies such as the EU Green Deal and the Fit for 55 package is driving investment in electric and hydrogen bus fleets, which require lightweight and energy-efficient door systems. Countries like Germany, France, the Netherlands, and the UK are leading in terms of fleet electrification. The European Commission’s Clean Vehicles Directive, which mandates public procurement of zero- and low-emission buses, is further boosting demand for integrated electric and sensor-based bus door systems. Technological sophistication, accessibility standards (UNECE Reg. No. 107), and preference for plug-type and inward sliding doors contribute to a mature, innovation-driven market.

Asia-Pacific is the fastest-growing and most dominant region, driven by massive urbanization, strong government investment in public transportation infrastructure, and the widespread push for clean mobility solutions. In China alone, more than 400,000 electric buses are currently in operation, accounting for over 90% of the global electric bus fleet. This rapid electrification fuels the demand for electric and smart door systems. Additionally, India, Japan, and South Korea are actively investing in metro bus projects, smart city programs, and BRT corridors that require advanced safety and accessibility features. Asia-Pacific’s market growth is expected to continue at a CAGR exceeding 8% through 2032.

These regions are witnessing gradual growth, primarily fueled by urban development, increasing public transport investments, and global donor support for clean mobility (e.g., from the World Bank and UNDP). Countries like Brazil, Mexico, South Africa, and the UAE are investing in next-generation city buses, metro bus systems, and regional transit upgrades. However, infrastructure limitations, high cost of advanced systems, and maintenance challenges continue to slow adoption compared to other regions.

The market was valued at USD 418.5 million in 2023.

The market is projected to grow at a CAGR of 4.5% from 2024 to 2030.

Asia-Pacific leads the market, holding approximately 45% of the global share by 2032.

Major players include Ventura Systems CV, Schaltbau Holding AG, Masats S.A., Continental AG, and Rotex Automation Ltd.

1.1 Summary

1.2 Research methodology

2.1 Research Objectives

2.2 Market Definition

2.3 Limitations & Assumptions

2.4 Market Scope & Segmentation

2.5 Currency & Pricing Considered

3.1 Drivers

3.2 Geopolitical Impact

3.3 Human Factors

3.4 Technology Factors

4.1 Porters Five Forces Analysis

4.2 Value Chain Analysis

4.3 Average Pricing Analysis

4.4 M & A, Agreements & Collaboration Analysis

5.1 Bus Door System Market, By Type

5.1.1 Introduction

5.1.2 Market Size & Forecast

5.2 Bus Door System Market, By Application

6.1 North America Bus Door System Market, By Country

6.1.1 Bus Door System Market, By Type

6.1.2 Bus Door System Market, By Application

6.2 U.S.

6.2.1 Bus Door System Market, By Type

6.2.2 Bus Door System Market, By Application

6.3 Canada

7.1 U.K.

7.2 Germany

7.3 France

7.4 Spain

7.5 Italy

7.6 Russia

7.7 Nordic

7.8 Benelux

7.9 The Rest of Europe

8.1 China

8.2 South Korea

8.3 Japan

8.4 India

8.5 Australia

8.6 Taiwan

8.7 South East Asia

8.8 The Rest of Asia-Pacific

9.1 UAE

9.2 Turkey

9.3 Saudi Arabia

9.4 South Africa

9.5 Egypt

9.6 Nigeria

9.7 Rest of MEA

10.1 Brazil

10.2 Mexico

10.3 Argentina

10.4 Chile

10.5 Colombia

10.6 Rest of Latin America

11.1 Global Market Share (%) By Players

11.2 Market Ranking By Revenue for Players

11.3 Competitive Dashboard

11.4 Product Mapping