Therapeutic Contact Lenses Market

Therapeutic Contact Lenses Market Share & Trends Analysis Report, By Product Type (Soft Lenses, Rigid Lenses, Specialty Lenses) By Application (Post-Surgical Healing, Corneal Disorders, Drug Delivery, Others) By Distribution Channel (Retail Pharmacies, Online Stores, Hospital & Clinics) Industry Analysis Report, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast, 2025–2033

Historical Period: 2019-2024

Forecast Period: 2025-2033

Report Code :

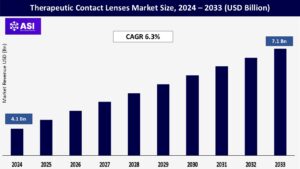

CAGR: 6.3%

Last Updated : September 30, 2025

The global Therapeutic Contact Lenses Market was valued at approximately USD 4.1 billion in 2024 and is projected to reach USD 7.1 billion by 2033, growing at a CAGR of 6.3% during the forecast period (2025–2033).

Therapeutic contact lenses are considered specialty lenses with the primary goal of doing more than correcting sight – they provide a protective layer and enhance recovery of the ocular surface. Examples of indications include corneal injury, post-operative healing, diagnosed dry eye, and various epithelial defects. Therapeutic lenses provide valuable protective covering, facilitate corneal healing, and also are available to use as drug delivery systems to provide an extended delivery option for ophthalmic medications. The market is growing due to an increasing prevalence of eye disease, the rise in acceptance of earlier eye care solutions, acceptance of alternative vision care methods, and the evolution of specialty lens materials like silicone hydrogel and scleral lenses. Demand is being amplified by advances in technology surrounding drug-eluting lenses, the public and practitioner awareness of better eye health, and the further market penetration of these products in both developed and emerging markets.

The increasing occurrence of ocular surface diseases is driving the use of therapeutic contact lenses, which include dry eye syndrome, untreated corneal abrasions and recurrent epithelial erosions. The American Academy of Ophthalmology estimates that more than 16 million adults in the U.S. experience dry eye disease, and the global burden of dry eye disease is increasing rapidly as the population ages and screen usage increases.

Therapeutic contact lenses, including therapeutic and bandage lenses, made with silicone hydrogel, are increasingly used to enhance corneal healing and reduce pain after corneal surgery. For instance, in 2023, Johnson & Johnson Vision launched Acuvue Theravision with ketotifen, the first drug-eluting contact lens approved by the FDA to treat allergic eye itch.

This shows the promise beyond the current use of therapeutic lenses for chronic and acute ocular diseases. The increase in refractive surgeries and corneal procedures taking place worldwide will also help drive the demand for therapeutic lenses for ocular surface diseases and enable surgeons to better care for their patients post-surgical procedures.

Advancements in materials science and ocular drug delivery systems have transformed the therapeutic contact lens landscape. Manufacturers are developing lenses that will elute sustained, controlled doses of medications directly to the eye, which helps overcome the poor patient compliance of traditional drops.

For example, MediPrint Ophthalmics is developing contact lenses for glaucoma that use prostaglandin analogs which will slowly elude. These developments could improve or eliminate the need for daily eye drops, if the lenses are already periodically placed on the eye for vision. Similarly, Johnson & Johnson Vision has continued development on the Smart Lens, which is a contact lens with the ability to monitor intraocular pressure for glaucoma patients.

The drug-eluting lenses, and the diagnostic lenses, will provide a constant therapeutic effect, while providing the therapeutic and comfort integration between the application of eye-drops into or upon the eye. Innovations in 3D prints and AI-enabled eye mapping software have also developed rapid individualized eye-wear creation by optimizing patient’s corneal topography.

This is expected to lead to not only better therapeutics but also patient satisfaction and comfort at the same time. With commercialization of these technologies possible, as they become profitable, they may also dramatically change the therapeutic landscape and potential of the market.

One of the principal limitations in the market for therapeutic contact lenses is the high cost and lack of inaccessibility for advanced therapeutic lenses, particularly in low- and middle-income countries. Therapeutics lenses, especially silicone hydrogel lenses and lenses having drug-delivery systems, are notably more expensive than standard vision-correcting lenses, and they can be very costly (even at several hundred dollars per lens for custom fit and scleral lenses which are often required for serious corneal conditions, or following surgery) and not all forms of therapeutic lenses are covered by every insurance provider.

Additionally, the cost of therapies can often include other costs, including fitting by a professionally trained service provider and the need for regular follow-ups. Cost can be a significant barrier to adoption, especially for patients with low awareness of costs and limited comprehensive health coverage.

There are also regional considerations like underdeveloped eye care systems or poor access to trained ophthalmologists and advanced eye care devices, particularly in emerging markets like parts of Africa and Southeast Asia, which also limits the adoption of therapeutic contact lenses. There will be more opportunity and growth potentials in more developed regions around the world, but the cost stands to hinder the market growth anyway, despite an increasing demand for non-invasive ocular therapy globally.

| Report Metric | Details |

|---|---|

| Segmentations | |

| By Product Type |

Soft Lenses Rigid Lenses Specialty Lenses |

| By Application |

Post-Surgical Healing Corneal Disorders Drug Delivery Others |

| By Distribution Channel |

Retail Pharmacies Online Stores Hospital & Clinics |

| Key Players |

Johnson & Johnson Vision Bausch + Lomb Alcon CooperVision Glint Pharmaceuticals Mojo Vision Menicon Co., Ltd. Contamac Innovega Inc. Novartis AG |

| Geographies Covered | |

| North America |

U.S. |

| Europe |

U.K. |

| Asia Pacific |

China |

| Middle East & Africa |

Saudi Arabia |

| Latin America |

Brazil |

The Therapeutic Contact Lenses Market is segmented by product type, application, distribution channel. Each segment plays a vital role in addressing specific ocular conditions, patient preferences, and distribution trends.

Utilization of soft lenses is the largest segment in the therapeutic contact lenses market. Recognized as the king and queen of comfort, flexibility, and oxygen transmissibility, the soft lens is manufactured from hydrogel or silicone hydrogel material. Soft lenses are the best therapeutic contact lenses used to treat ocular surface disease in the post-surgical recovery, corneal abrasions, and epithelial defects.

Soft lenses, due to biocompatibility, and lack of irritation disposes themselves well to extended wear and drug-eluting type lenses. The demand is forecasted to remain steady, as soft lenses are increasingly used for pediatric myopia control and dry eye therapy. Rigid lenses (also termed RGP, or rigid gas permeable) account for a smaller but significant portion of the market share.

Rigid lenses have increased sharpness of vision and are usually preferred when soft lenses are ineffective, such as with severe keratoconus, significant astigmatism, and corneal ectasias. Rigids are less comfortable but better durable lenses that adapt refractive errors more precisely and typically accommodate custom manufacturing for complicated ocular pathologies.

Specialty lenses, including scleral lenses, hybrid lenses, and orthokeratology (ortho-k) lenses, are on the rise in popularity. Scleral lenses fit over the cornea and rests on the outer white part of the eye called the sclera. Scleral lenses are used to provide comfort to patients with corneal ectasia, ocular surface disease, Stevens-Johnson syndrome, or graft-versus-host disease.

Scleral lenses can also be used as a reservoir for saline or medicated solutions, allowing superior retention of drugs and hydration of the cornea. As custom therapeutic lenses become the norm, this will grow rapidly.

The post-surgical healing segment captures the largest market share, fueled by the incredible use of therapeutic lenses after patients are subjected to refractive surgeries (LASIK, PRK), cataract extraction, or cornea transplantations. The therapeutic lenses used in these cases act as a bandage for the cornea, both protecting the cornea, helping with re-epithelialization, and relieving pain.

The overall increase in global volumes of ophthalmic surgeries has greatly augmented this segment’s growth. Corneal disorders such as recurrent corneal erosion, neurotrophic keratitis, dry eye syndrome, and corneal ulcers accounts for a huge part of therapeutic lens use. Therapeutic lenses provide protection to the ocular surface while permitting a healing environment, relieving pain to maintain lubricating or antibiotic drops to optimize the use of therapeutic lenses.

With the increasing prevalence of dry eye and ocular surface disease in a geriatric population growth trajectory, this segment is expected to maintain a steady growth pattern. Drug delivery is an emerging segment, representing a technological innovation and advancement. Therapeutic lenses containing pharmaceuticals embedded with controlled-release delivery mechanisms provide sustained liquid medication to the eye, providing significantly greater bioavailability compared to conventional eye drops.

Lenses that deliver antibiotics, anti-inflammatories, and glaucoma drugs are in clinical trials or early market launch. As more products reach the market and the regulatory pathways become established and clear, this segment is anticipated to accelerate quickly.

Others include niche therapeutic applications such as UV protection, pain management, or lenses used for rare conditions like bullous keratopathy and exposure keratitis. These lenses, while serving a smaller patient base, are critical for improving quality of life and offer targeted therapy in complex ocular conditions.

Retail stores currently dominate the segment of distribution channels. The physical accessibility of retail chains and the typically large stock of prescription and therapeutic lenses had established retail chains as a point of purchase, especially for patients with chronic conditions or who have regular prescriptions with their ophthalmologist.

The growth of online stores is the newest and fastest-growing area of lenses dispensing largely due to the explosive growth of e-commerce itself, increasing opportunities to improve digital literacy, and the demand from consumers for “drop at your door step” service. Online stores can provide subscription services, virtual fittings, and tele-optometry to support consumers who are users of daily disposable or specialty therapeutic lenses.

Additionally, the growth of consumer trust in licensed dispensers supporting their online store has provided more credibility in this channel as a retail purchase opportunity. Hospitals & clinics will always be present and critical, especially for people who have received lenses after surgery or those receiving treatment for serious corneal diseases.

Therapeutic lenses in a clinical setting typically do not have the prescription dispensed independently, as they would be done under the professional care of the ophthalmologist utilizing a professional dispensing practice, the lenses could be considered custom lenses, largely based on ocular measurements and specific pathology. Hospitals and clinics will have a greater role with tertiary care and specialty ophthalmic hospitals.

North America had the biggest market share of 39.2% in 2024 demonstrating its leadership position in the therapeutic contact lenses market. North America is able to maintain this leading position for a variety of reasons: advanced ocular infrastructure, supportive regulatory environment for novel products, and high prevalence of ocular surface diseases including dry eye syndrome, and complications after refractive ophthalmic surgeries.

The US successfully adopted therapeutic contact lenses followed by global leaders like Johnson & Johnson Vision, CooperVision and adoption rates of LASIK, cataract and various ocular surface disease therapies. Additionally, continued successful FDA regulatory approvals for drug eluting lenses and smart lens technologies reinforces the idea that region is primed for future innovation.

Europe held a 27.5% market share in 2024, supported by both comprehensive healthcare systems, and high levels of investment and research in eye health. Germany, the United Kingdom, France, and the Netherlands have significantly high adoption rates, particularly in therapeutic lenses for chronic ocular disease and post-surgical applications.

With an aging population, supportive reimbursement and policies in place, high incidence of corneal dystrophies, and recurrent erosions, the demand for ocular health is strong. Notably, there is growing academic research on drug-releasing ocular devices which could further advance the innovations for ongoing therapeutics in the region.

Asia-Pacific is the fastest growing region, with a projected CAGR of 7.8% during the forecast period and a market share of 21.3% in 2024. The expansion is driven by high urbanization, increasing healthcare expenditure, and a rising burden of myopia and its complications. China and India are the largest growth opportunities, due to a very large population with an increasing number of individuals gaining access to good quality eye care.

Japan and South Korea are developing countries with early market penetration and experience with advanced contact lens technologies. Additionally, vision care programs funded and/or enabled by government support, along with local production, enable faster penetration into these markets.

In 2024, Latin America will contribute approximately 6.1% to the global market share. The region is slowly showing growth opportunities particularly due to improvements in healthcare infrastructure occurring gradually throughout the region including: Brazil, Mexico and Argentina. The awareness of ocular health is improving and there are an increasing number of refractive surgery and cataract surgery performed annually which is improving the therapeutic contact lenses market. However, overall healthcare access and affordability has meant that the market is lower than the global average.

MEA had only 5.9% share in 2024, which is a burgeoning area. The Gulf Cooperation Council (GCC) countries including Saudi Arabia and the UAE are having meaningful engagement as they invest in premium health infrastructure and medical tourism. While the wider African region presents some accessibility issues and inexpensive options, the interventions of specific NGOs and government health agencies are steadily improving access to ocular treatments, including therapeutic lenses.

The market was valued at USD 4.1 billion in 2024.

The market is projected to grow at a CAGR of 6.3% from 2025 to 2033.

The Soft Lenses hold the largest market share.

The Asia-Pacific region is expected to witness the highest growth rate.

Major players include Johnson & Johnson Vision, Bausch + Lomb and Alcon.

1.1 Summary

1.2 Research methodology

2.1 Research Objectives

2.2 Market Definition

2.3 Limitations & Assumptions

2.4 Market Scope & Segmentation

2.5 Currency & Pricing Considered

3.1 Drivers

3.2 Geopolitical Impact

3.3 Human Factors

3.4 Technology Factors

4.1 Porters Five Forces Analysis

4.2 Value Chain Analysis

4.3 Average Pricing Analysis

4.4 M & A, Agreements & Collaboration Analysis

5.1 Therapeutic Contact Lenses Market, By Product Type

5.1.1 Introduction

5.1.2 Market Size & Forecast

5.2 Therapeutic Contact Lenses Market, By Application

5.3 Therapeutic Contact Lenses Market, By Distribution Channel

6.1 North America Therapeutic Contact Lenses Market, By Country

6.1.1 Therapeutic Contact Lenses Market, By Product Type

6.1.2 Therapeutic Contact Lenses Market, By Application

6.1.3 Therapeutic Contact Lenses Market, By Distribution Channel

6.2 U.S.

6.2.1 Therapeutic Contact Lenses Market, By Product Type

6.2.2 Therapeutic Contact Lenses Market, By Application

6.2.3 Therapeutic Contact Lenses Market, By Distribution Channel

6.3 Canada

7.1 U.K.

7.2 Germany

7.3 France

7.4 Spain

7.5 Italy

7.6 Russia

7.7 Nordic

7.8 Benelux

7.9 The Rest of Europe

8.1 China

8.2 South Korea

8.3 Japan

8.4 India

8.5 Australia

8.6 Taiwan

8.7 South East Asia

8.8 The Rest of Asia-Pacific

9.1 UAE

9.2 Turkey

9.3 Saudi Arabia

9.4 South Africa

9.5 Egypt

9.6 Nigeria

9.7 Rest of MEA

10.1 Brazil

10.2 Mexico

10.3 Argentina

10.4 Chile

10.5 Colombia

10.6 Rest of Latin America

11.1 Global Market Share (%) By Players

11.2 Market Ranking By Revenue for Players

11.3 Competitive Dashboard

11.4 Product Mapping